The European context

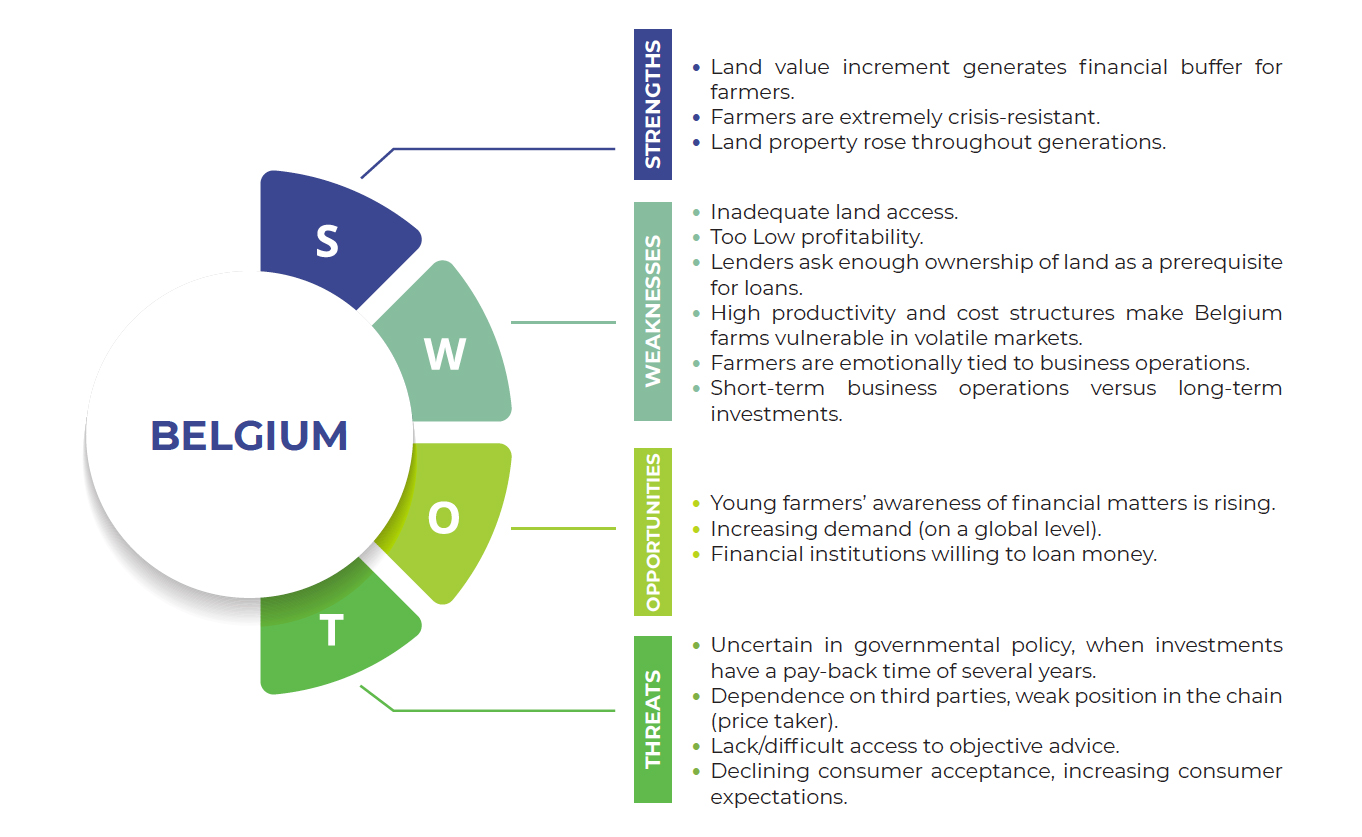

Through this guide we will learn about the actual situation of innovative financing in family Farming in Europe. The guide begins with a general introduction to the farming sector in Europe, followed by an overview of the financial sector for farming. It concludes with a section dedicated to financial training for farmers and a SWOT analysis.

The countries of the European Union maintain heterogeneity among their production structures, their crops, their climate, and their agricultural landscapes. However, they all have to face some common challenges in the coming years, such as increasing competitiveness in a global market, preserving the environment with more sustainable production, adapting to new technologies and forms of production, adapting to market demands, uncertain prices and climatic conditions, all with unstable and precarious profitability.

In addition to these challenges, the sector has certain peculiarities from the point of view of collection and payment management. For example, long production cycles that generate temporary delays between the expenses necessary to produce and the income obtained from production. In addition to a production that is increasingly dependent on climatic conditions, which increases the perception of uncertainty.

These structural characteristics pose different financing challenges in respect to other sectors. On the one hand, short-term cash needs to meet operating expenses, and on the other hand, investment needs to adapt to the challenges of the future in the long term, make it advisable to rely on the financing tools available in our financial system.

But despite being aware of this need, farmers do not have a clear understanding of financial options, which limits their willingness to make use of them, taking refuge in obtaining subsidies as a preferred form of financing.

Only those countries with production structures that are more demanding of large investments, with fewer family farms in favour of agricultural corporations, maintain higher debt ratios and have a greater approach to and knowledge of traditional financial concepts and tools.

The new financial products and the more innovative forms of financing have not yet reached the majority of farmers, who prefer to approach more traditional forms of financing.

However, not all farmers can access financing through the usual channels, as the requirements imposed by financial institutions sometimes do not take into account the reality of the agricultural sector. This factor is important as it limits access but also the willingness of farmers to approach financial institutions as regular providers.

For this reason it is important to increase the financial culture through training, giving resources to be able to evaluate other less restrictive financing options, either through associative forms or with new legal structures, there are those alternative and innovative forms that can help the agricultural sector face the challenges of the future.

The “Agriculture, forestry and fishery statistics” (European Commission, 2018) outlines the major trends in the European farming sector, based on the latest collection of data under the Farm Structure Survey of 2016. The main trends are:

- In 2016, there were 10.5 million agricultural holdings in the European Union (EU) and farm numbers have been in steep decline for many years.

- Farming remains a predominantly family activity: in 2016, 96% of the EU’s farms were family farms.

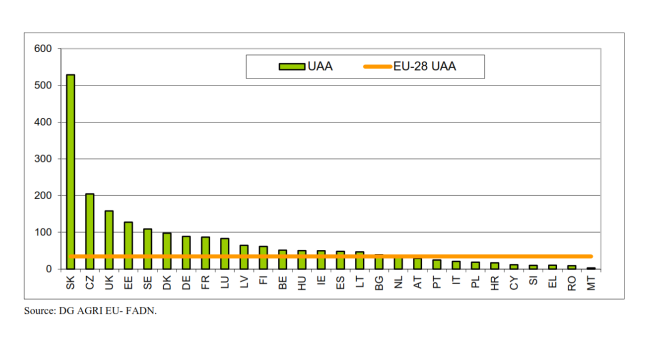

- Most of the EU’s farms are small in nature: two thirds were less than 5 hectares in size (Fig.1).

- EU farms can be broadly characterised as either (i) semi-subsistence (ii) small and medium-sized farms or (iii) large agricultural enterprises.

- EU farms used 173 million hectares of land for agricultural production in 2016, which is about 39 % of the EU’s total land area.

- About 246,000 farms had some organic area in 2016. This number was about one fifth higher than in 2013.

- Organic farming covered 12.6 million hectares of agricultural land in 2017.

- One quarter (25.1 %) of all the EU’s farms were specialist livestock farms in 2016 and just over half (52.5 %) were specialist crop farms.

- About 9.7 million people worked in agriculture in the EU in 2016.

- Farmers are typically male and relatively old; 71.5 % of farmers were male in 2016 and only one in ten (10.6 %) were under the age of 40 years old in 2016.

- €59 billion was invested in agricultural capital in the EU in 2018, which was an estimated €2.3 billion more than in 2017.

- There are considerable variations in agricultural land prices and rents between and within Member States (Fig. 2).

- In some cases, there may be a contradiction between more productive and competitive agricultural systems (industrial crops) and the maintenance of ethical production systems (environmentally friendly, animal welfare and climate protection).

- The solution to these conflicting positions will define the future of the standardization of organic production as the prevailing production system.

- The future of the countryside will be linked to climate change and soil conservation, so it is important to adapt farms to future limitations.

- The agricultural sector is starting to undergo a revolution, a higher level of innovation, technification and complexity is expected in the future, so a change of mentality is required. It will be necessary to increase the professional profile and knowledge with more training, development of new skills, but allowing advice on technical, bureaucratic, and financial aspects.

There is a need to develop more initiatives for cooperation and representation of the common interests of farmers, to generate greater income, to ensure the profitability and future sustainability of farms in the medium and long term.

- Commonly cited among experts was the need to improve product marketing processes, assure competitive prices, reduce production costs with greater mechanization of the sector, increase diversification of agricultural income resources, and above all, to enhance product quality and differentiation for the consumer by increasing the perceived added value.

- Agriculture must respond to consumer demand for healthier products, maintaining forms of management and handling that respect the environment and the landscape.

- The high average age of the agricultural sector limits change, and there is excessive conservatism. Succession processes need to be defined to facilitate generational renewal, therefore allowing opportunities for young farmers.

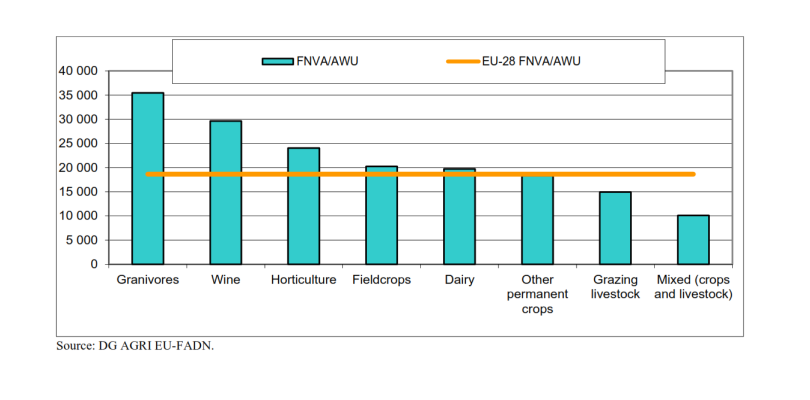

- The livestock sector is at greater risk, from the point of view of competitiveness, than the plant production sector.

- Many of these challenges are linked to capital-intensive farming, which will have to be financed from outside resources, given the expected lower level of CAP payments, which will affect the debt position of many farms.

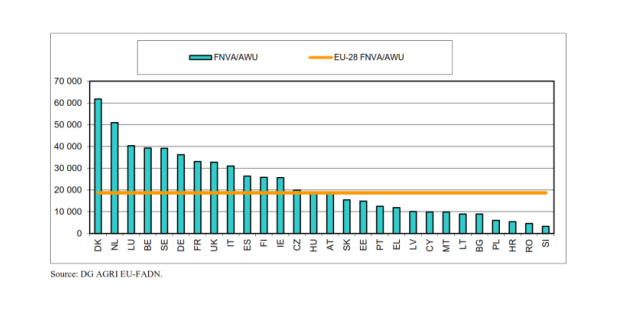

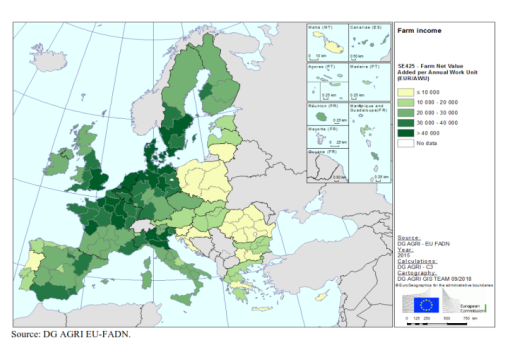

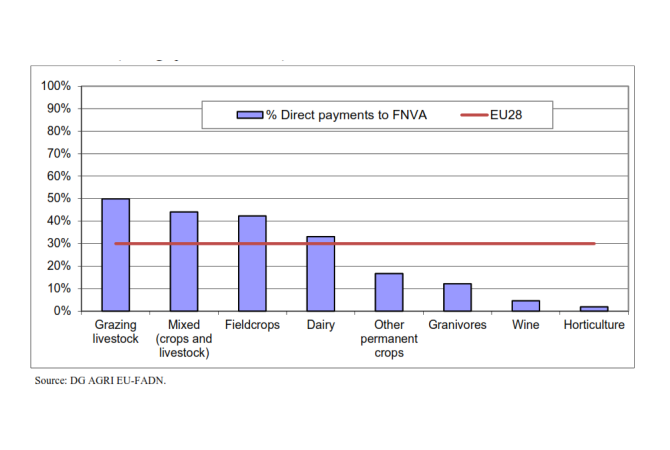

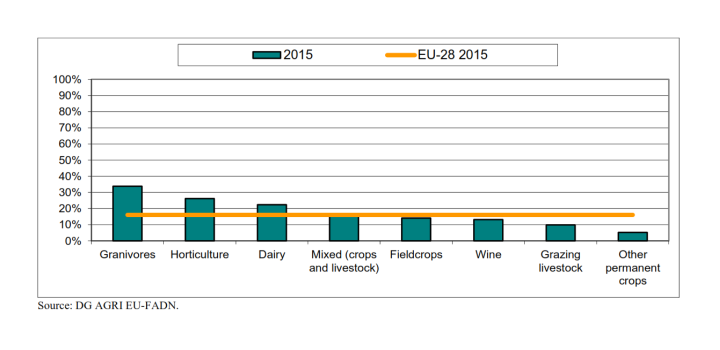

Profitability levels are uneven among farmers (Fig. 3-5). Many farms are not profitable due to small size and/or maintenance of traditional systems and structures, which do not make them competitive compared with larger professional farms.

- Most farms in Europe belong to individual farmers or family farms, their cost-benefit structure is usually in deficit, having to lose part of their remuneration as self-employed person. This ratio is worse in areas with natural and productive difficulties. But, in the other hand, it is better performance when the farm size is greater or has additional activities (multifunctionality) as source of income (Fig. 6).

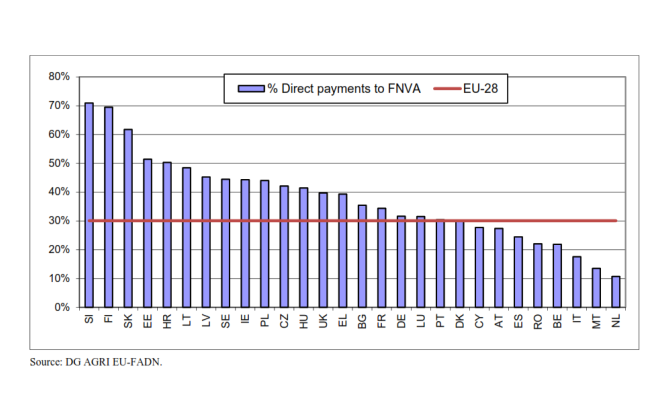

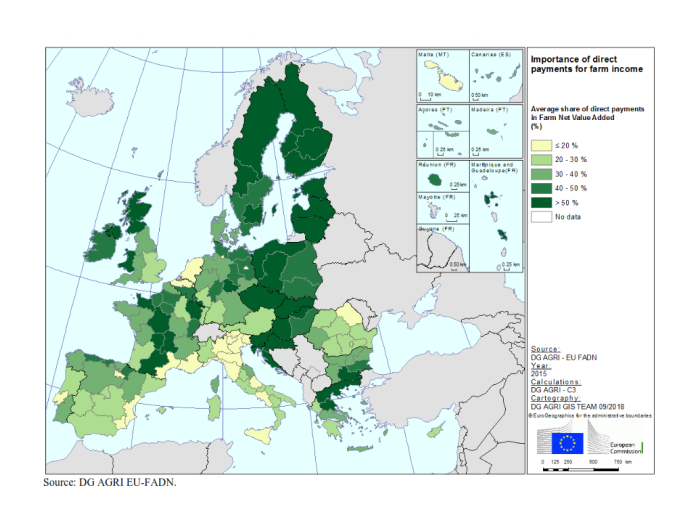

- Apart from the structure of the farms themselves and their efficiency in the use of the means of production, the high dependence on raw materials, as well as the low value of agricultural products, places farms in delicate positions, forcing them to have high productivity, being very cost efficient, and highly dependent on EU PAC grants (30% of FNVA in the EU-28).

- The low prices of agricultural products are limiting the possibilities for growth, improvement and adaptation of many farms that find it difficult to cover their production costs.

- From a financial point of view, it is important to adapt investments, so they generate income, while seeking cooperative solutions (partnership, renting or subcontracting) so as not to acquire high debt positions.

- Funding is a key factor for agricultural activity. Lengthy production periods, deferred income, high year-on-year variability in production, and the need to undertake investment projects oblige farmers to have adequate sources of finance.

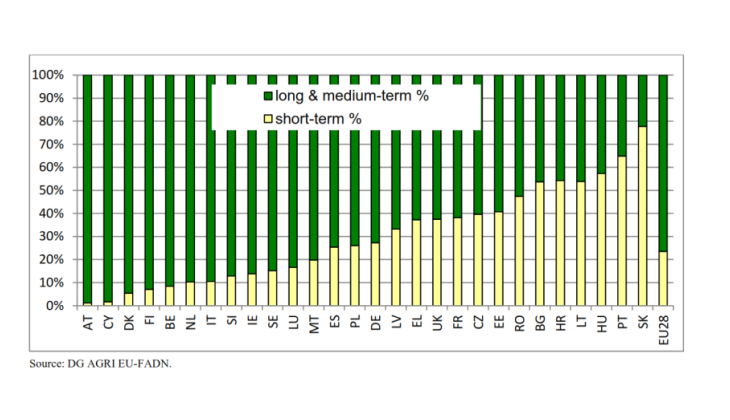

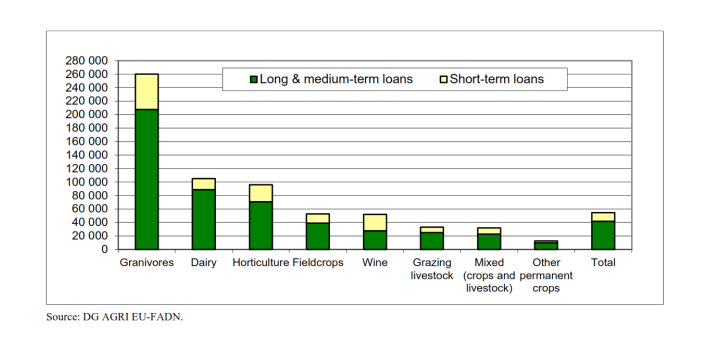

- The financing needs of farmers are based on two-time frames (Fig.7):

- In the short term: to cover the liquidity gap between expenses and future income resulting from crop yields and CAP direct payments. Cash-flow management becomes essential to face speculative strategies, or to face bad harvests due to adverse climate, making specific financial products necessary. In this sense, advanced harvest payments, advanced CAP payments, credit policies, factoring and confirming are common.

- In the long term, to cover investments to set up new farms or improvement of existing ones (purchase of machinery, purchase of land or improvement of facilities), which requires specific products with financial amortization ranging from 5 to 15-20 years. Here, personal loans and mortgages are the most common.

- Funding needs also depend on the type of activity being carried out:

- In the case of farms focused on plant production (e.g. rapeseed, cereals), we most often encounter challenges regarding operating loans due to uneven cash flow. Insufficient storage production is also a problem for these producers.

- The lending of large investment units in livestock production is used to generate resources for the purchase of land and the purchase of innovative machines (systems) in crop production (Fig.5).

- In the case of family farms, there are investment needs to shorten supply chains (sales or production processing, meat cutting plants, cheese factories, etc.).

- The evolution of agricultural market prices in recent years has consumed the liquidity reserves of many farmers, thus making them susceptible to use financial products to cover their working capital for the year or for longer cycles.

- To cover these needs, farmers find adapted financing formulas with very low subsidized interest rates, lower than in other sectors. We are talking about fixed rates at 2% and variable rates of Euribor + 1.5-2 p.p. There are even commercial machinery houses that offer financing forms at 0% financial cost.

- However, and despite this financing offer, a good portion of these financing needs are covered through subsidies and aids, mainly those coming from the Common Agricultural Policy (CAP), but also from autonomous, regional, provincial and even municipal sources (Fig.8-10).

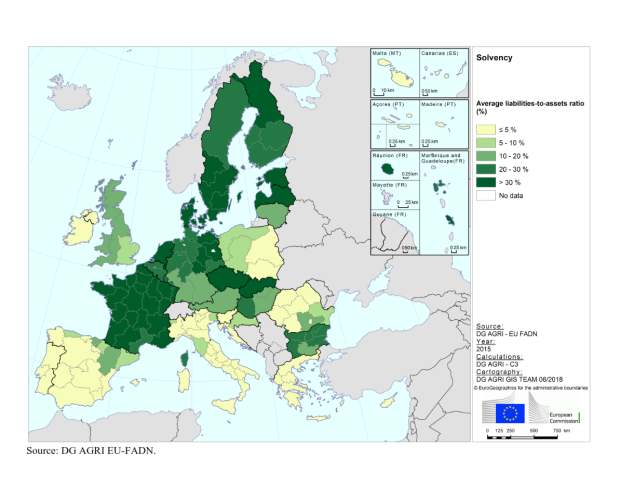

- The level of debt in each country (Fig. 11) depends on the profile of the farmer and type of farming, the average liabilities-assets ratio is close to 16% in EU farms. Farms in peripheral and southern European countries, with relatively large numbers of family farms, maintain on average lower debt ratios compared to total assets. This is explained by the fact that they have more conservative and adverse debt profiles, and on the other hand, they maintain worse scores that hinder access to external financing.

- In countries with a more entrepreneurial approach, defined as those with larger farms where investments are increasing significant and financing processes have been growing in recent years, there is greater debtor ratios (Fig. 12-14) and the assumption of more risks. For this reason, in countries like Germany, a third of farms are experiencing financial difficulties, which is generating an increase in default.

- Due to economic pressure and the situation described above of course amortization durations and poor liquidity on average lead to longer durations of the loan compared to other business sectors.

- Financing processes are linked to demonstrate sufficient capacity to generate income, sufficient guarantees and/or endorsements. Financial institutions must protect their liability portfolio, so the regulations require financial institutions to carry out risk studies and assess their customers based on standardised rating and scoring criteria. Some difficulties or limitations to access financing, arise from the possibility of satisfying the income generation and profitability requirements:

- Regions or countries with greater production difficulties (water, soil, mountain constraints, etc.) or with poor production structures (small size, traditional and extensive management, etc.) maintain lower levels of profitability, which hinders their ability to generate sufficient net margins to access third-party financing.

- Young people and new entrants face many challenges, such as: insufficient experience, lack of credit record, lower equity capital, and barriers in accessing outside finance (especially if they do not have sufficient guarantees and collateral).

- Some tax models estimate the net margin as a ratio of total income. This tax regime aims to benefit the farmer fiscally but reduces their possibilities of indebtedness by considering net income lower than that received.

- On other occasions, the search for tax savings has led farmers to distribute their income among family members. This implies reducing the capacity for individual income generation, as well as the possibility of applying for funding for the whole farm.

- This same search for tax savings has led farmers in direct estimation systems to allocate excessive volumes of expenditure to reduce their net margins, which also limits their capacity to borrow from credit institutions.

- Many entities have had to design alternative measurement systems to the standard in order to justify the suitability of farmers for the granting of funding, with more realistic valuations than those contemplated from a fiscal framework.

- Agricultural activity is full of risks that can impact crop and livestock production, their market value, and ultimately, farm profitability. That is why, in the absence of other guarantees, many banks require yield agricultural insurance to be taken out to provide financing. This makes such financing more expensive.

- Financial institutions usually offer financing models that do not cover more than 70% of the investment, so the farmer must have the capacity to co-finance the object of purchase. For many farmers who are starting out, this financing model is difficult to take on board. Even if they have been granted subsidies, they must finance 30% of the investment without knowing when they will receive the amount of the subsidy, assuming 30% of the initial capital plus the amortization of the financed capital and its interest.

- The options for increasing profitability via income, in recent years, have come from increases in productivity and the development of new activities. On the other hand, neither price trends nor evidence of climate change seem to favour increasing profitability in the sector. This perspective entails an additional difficulty in the capacity to access third-party financing, linked to the capacity to generate income, especially if we compare it with the evolution of other more stable and profitable sectors, which attract more interest from potential investors.

- Although there are exceptions and the scenario is changing, in some countries the financing is highly focused on financial entities that follow centralized and standardized evaluation procedures. These entities do not take into consideration the reality of the agricultural sector, without the capacity to adapt their products to the financing needs of the farms.

- At present, as a result of COVID-19, although the general aim is not to increase the debt ratio, public financing and public guarantees are demanded as a preferred financing channel for all sectors, but we find there is great competition to access these limited financing tools.

- This type of public financing is also evaluated by two entities: on the one hand, the public entity that calls for the financing budget, and, on the other hand, the evaluation of the financial entity that serves as distributor of that line of financing. This double assessment makes access to these lines even more difficult.

- The entities positively value the fact that part of the investment is paid with their own funds or that the investment has the capacity to pay the amortization of the financing and generate profits in the short term. If this does not happen, it is necessary to justify a business plan, for which it is necessary to think very carefully so as not to fail in the request for financing or in the execution of the project.

- The entities also value projects developed in phases, which cover growth in stages, and which distribute the financing needs in the medium and long term.

- Those countries and regions, whose climatic conditions and production structures make it difficult for farms to be profitable, find it more difficult to access traditional financing. It is on these farms where they can make more sense the use of non-traditional and innovative forms of financing, as well as cooperative and associative forms.

- Problems of late payment are infrequent in the agricultural sector. The conservative characteristics and savings capacity of farmers allows many investments to be financed by co-payment of own funds and/or public subsidies. In addition, many farmers tend to have assets that provide sufficient guarantee as they can be made liquid more easily than urban real estate.

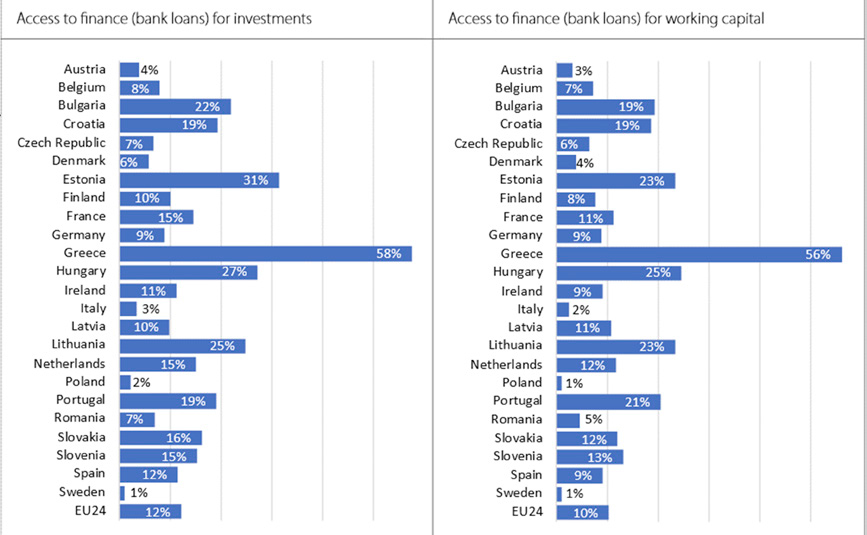

In 2019, the report “Survey on financial needs and access to finance of EU agricultural enterprises” based on an EU-wide survey conducted by fi-compass with 7,600 farmers from 24 Member States of the European Union was published.

According to it, access to finance, especially bank loans, was crucial for 12.2% of all farmers who used them to make investments and 10.4% used bank loans for working capital (Fig.1).

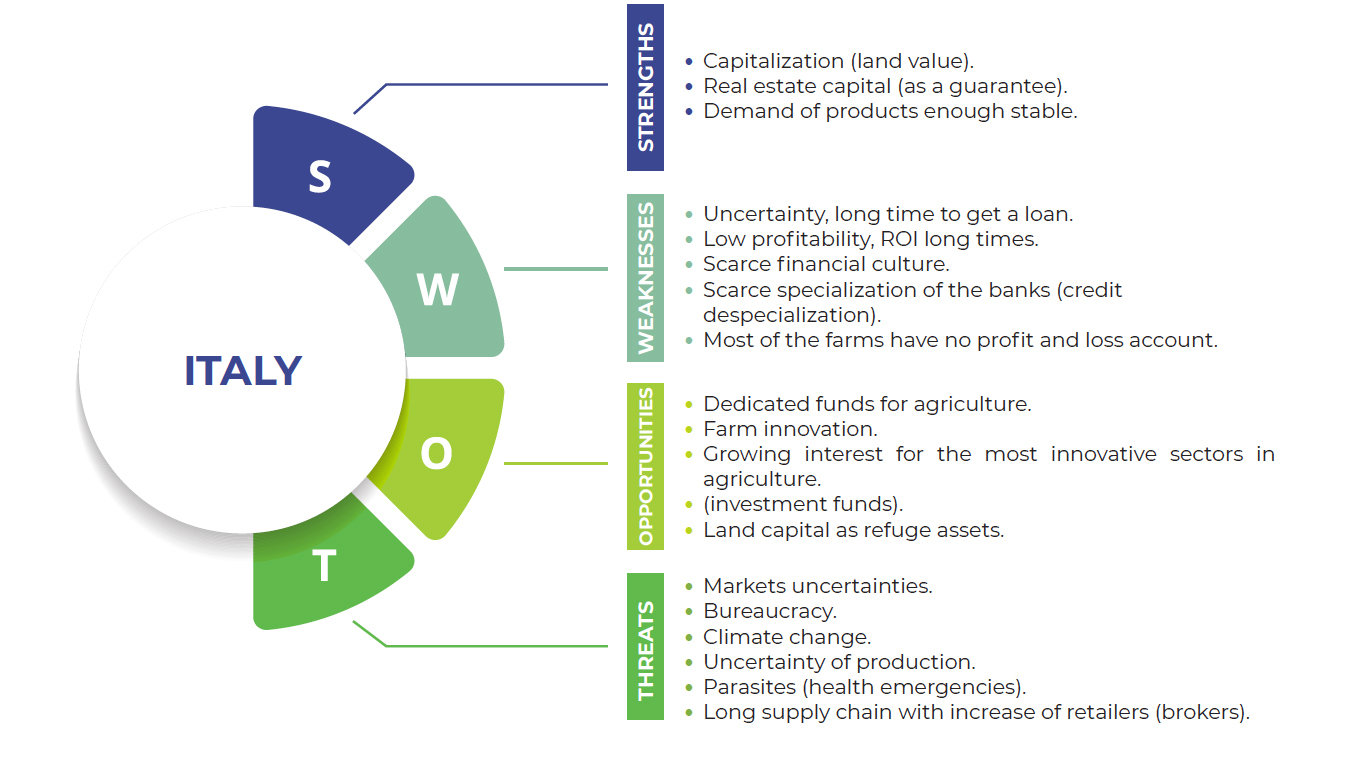

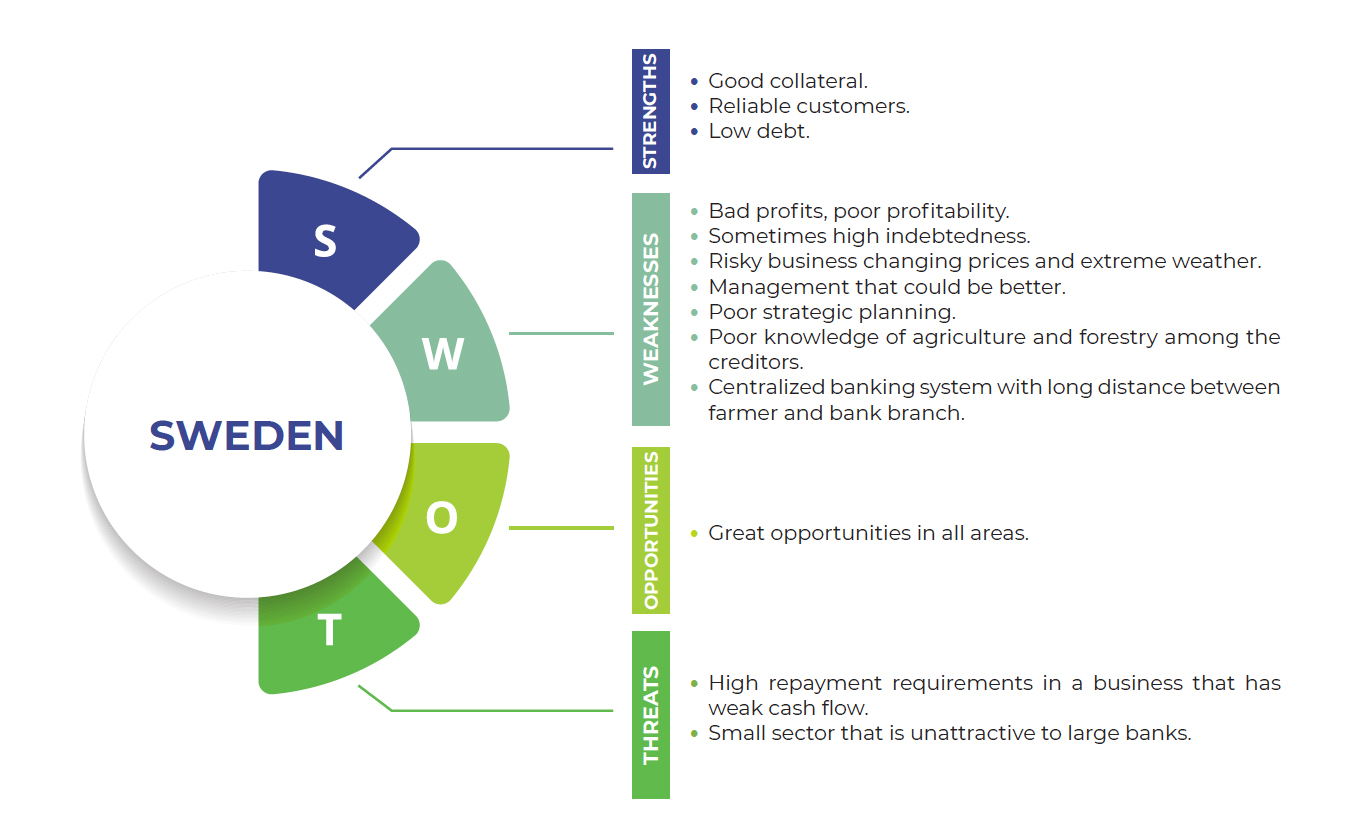

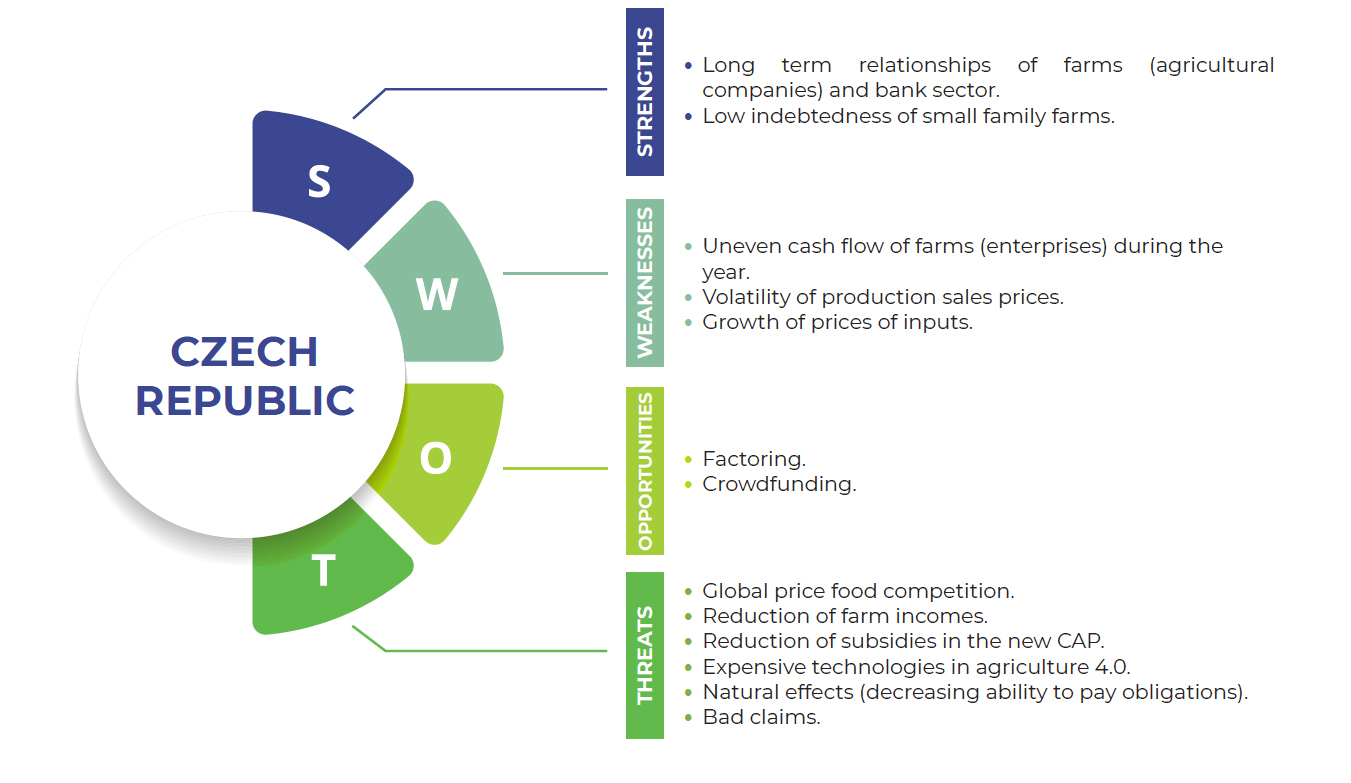

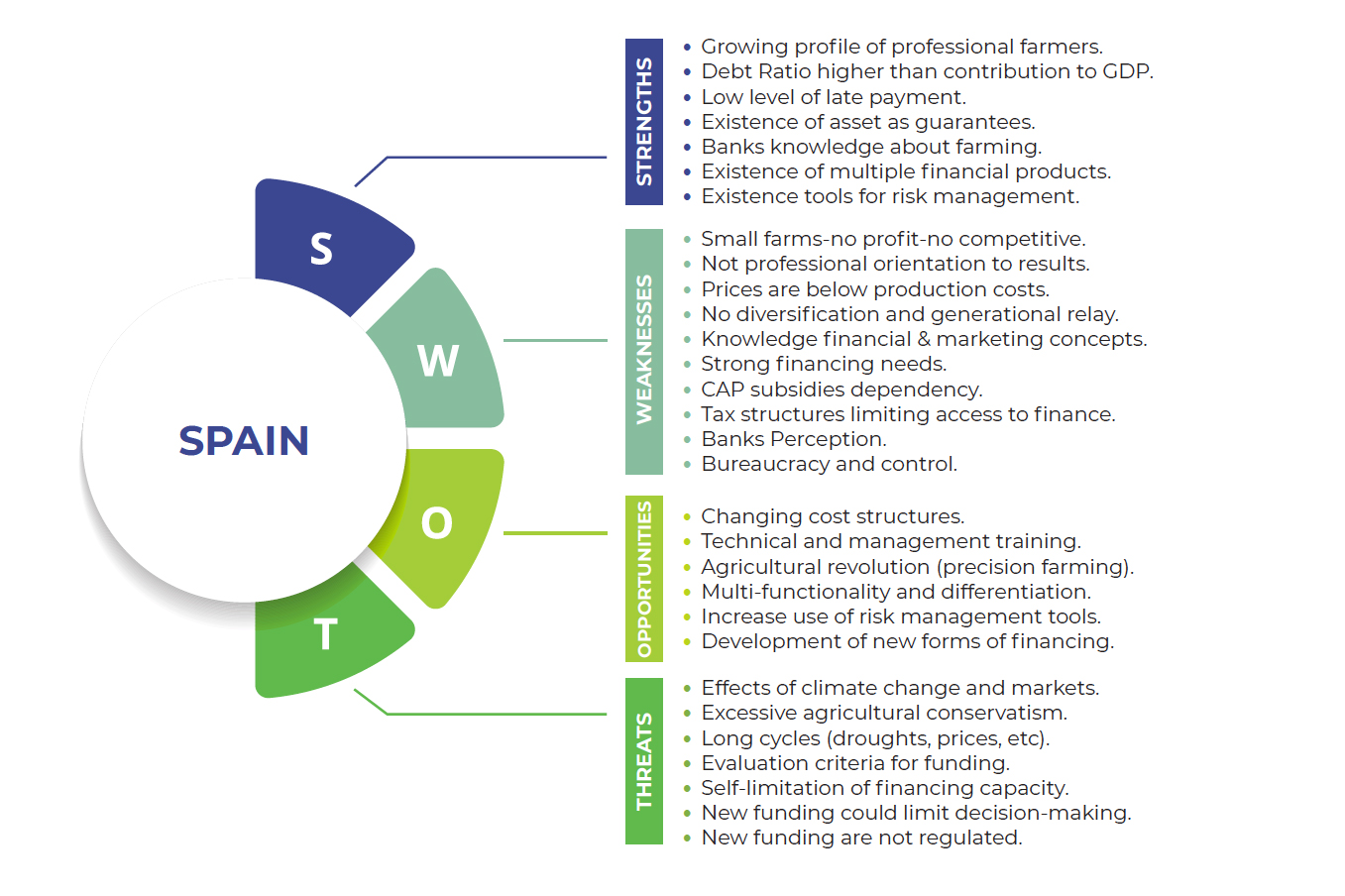

There were important differences between Member States (Fig. 2). Access to finance was particularly problematic in Greece (more than half of farms experienced difficulties in accessing finance in 2017) and in Estonia, Hungary, Lithuania, Bulgaria and Portugal. On the other hand, for farms in Poland, Sweden, Italy and Austria, access to finance was less difficult than for the EU-24, on average.

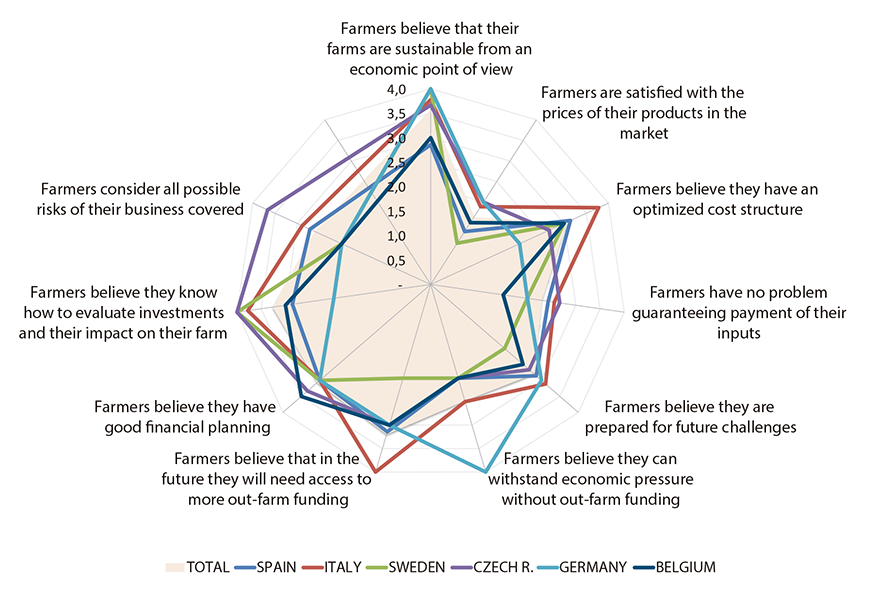

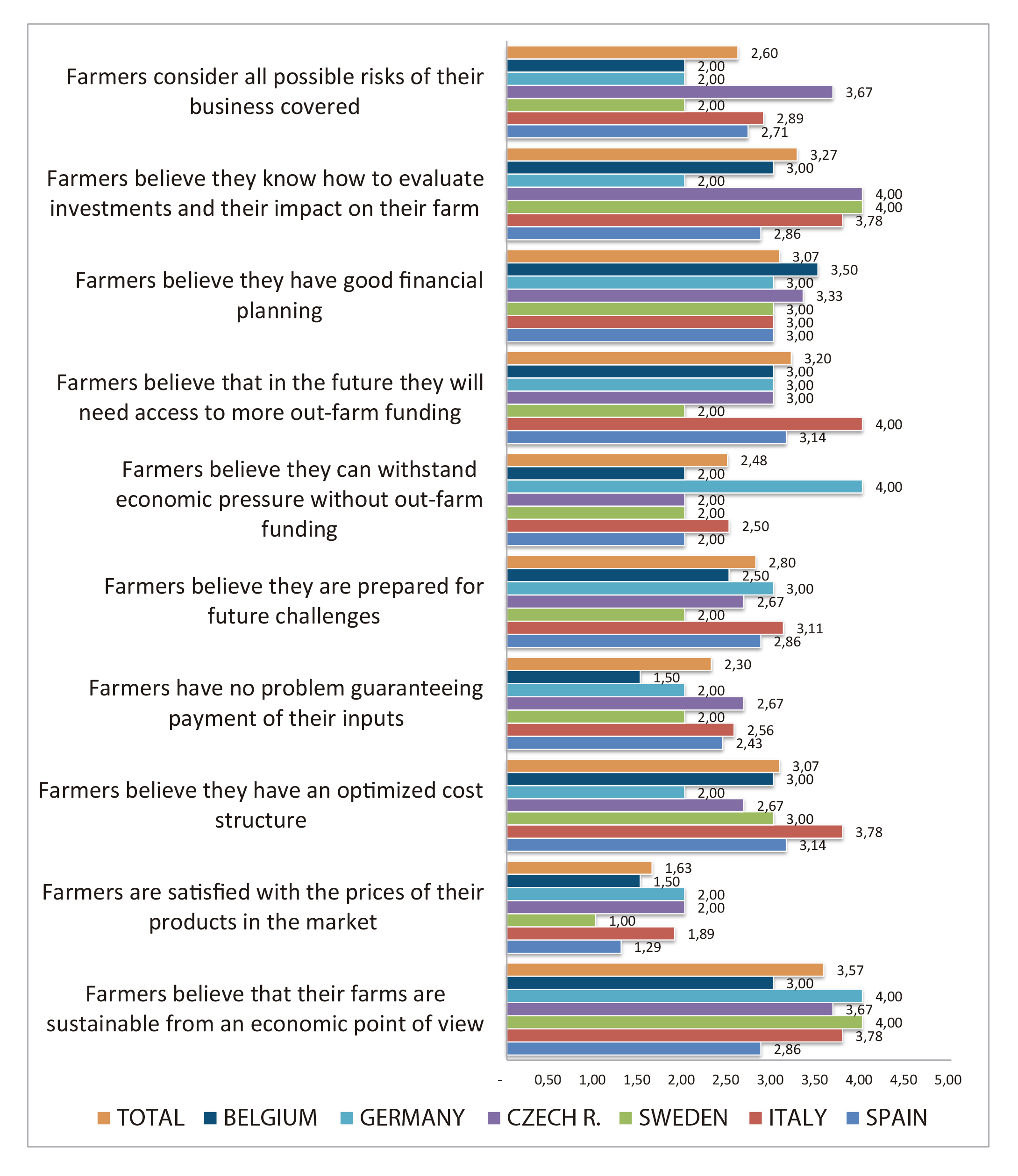

- In general, the interviewees stated (3.57/5) that the farmers consider their farms as economically sustainable, only in the case of SPA and BEL the statement is more nuanced.

- In spite of this consideration, it is evident the general dissatisfaction (1.63/5) with the prices

perceived on the agricultural markets. - Additionally, farmers are generally satisfied (3.07/5) with their cost structure (SPA, SWE, CZR, BEL), with ITA‘s perception of efficiency being the highest, and only GER considers their farms as inefficient.

- In general, there appears to be some challenges (2.3/5) in guaranteeing farm input payments, with GER, SWE, and BEL appearing having the most difficulties.

- Farmers, aware of the uncertainties that characterise their sector, are not fully prepared (2.8/5) for the challenges ahead, with GER and ITA perceive themselves to be the most prepared, while SWE appears to have the worst prospects.

- With the exception of GER, all countries seem to be aware that they may need (2.48/5) external financing to withstand economic pressures on their farms. Despite this, with the exception of ITA, they do not believe (3.2/5) they will need more external funding in the future. This may be due to the fact that they consider their current financial planning (3.07/5) to be sufficient.

- While BEL, GER and SPA state that their investment evaluation capacity can be improved, SWE, CZR, and ITA feel quite capable of evaluating investments (3.27/5).

- Finally, with the exception of CZR, all countries consider that they are not covered for all the risks that may affect their activity (2.6/5).

To conclude, often farmers declare that their farms are economically sustainable, probably due to financial planning. But, at the same time, they recognise that they face difficulties in sustaining their business. This makes them aware of the need for external financing, but they are cautious about going down this road in the future.

I Farm structure by country (bar chart)

- Although it depends on the profile of each agriculture-related business, in general and with the exception of public aid from the EU, there is a lack of knowledge among farmers about traditional financing concepts and instruments, even more so about innovative or non-common tools. If knowledge is scarce, we can say that the use of such instruments is also scarce.

- The recent history of financial institutions, during the 2008 crisis, has led to a certain amount of mistrust towards these institutions and the new products they make available to citizens and entrepreneurs.

- The complex bureaucratic processes, the growing request for documentation and the perception of supervision through financial institutions, also limit the approach and trust in banks.

- Depending on the profile of the farmer, there is a lack of knowledge and a certain lack of interest in the new financing instruments available. Farmers tend to show more interest and confidence in traditional products they already know, such as credit lines and loans.

- This distrust and lack of knowledge in applying for financing means that many farms do not evolve, limiting their capacity to grow, and condemning them to maintain structures that are less and less competitive and profitable.

- Farmers are unaware of the existence of financing lines protected by public entities such as ICO or SAECA, in Spain or ISMEA in Italy. That offers them financing options of 100% of the capital at very competitive interest rates and with public guarantees that guarantee the operation. These conditions, together with agricultural insurance, are unthinkable in other sectors, which have greater access to debt with worse conditions.

- The profiles of younger farmers, as well as professional farmers and cooperatives with an approach to business oriented towards controlling income and expenses, are those who show the most interest and are most often close to traditional financing.

- As discussed in the previous section, the best known and most widely used financing instruments, in the short and long term, are harvest advances, advances from CAP, the line of credit, factoring, confirming, personal loans and mortgage loans.

- It is highly recommended to seek professional support in the field of financing: its basic conditions (interest rate, duration, mortgages), as well as its meaning for the business (role of the investor / bank, rights of the investor / bank, etc.) as described in the table of financing tools.

- The willingness of farmers to use off-farm financing depends on the profile. For example, young entrepreneurs, due to lack of equity, often access financing and adopt forms of management that seek efficiency. Those farmers whose only source of income is agriculture have access to funding to grow their farms and evolve. Cooperatives and large agricultural companies are very intensive in the use of financing tools to cover their cash flow needs and to improve their facilities.

- Traditional farmers only invest if they can utilise their own funds or public funds (up to 80% and with amortization of the short-term financing). In many cases, due to the advanced age of farmers, the small size of farms, their low financial culture, their risk aversion and mistrust in the financial sector, we find a low willingness to use external financing if it is not absolutely necessary. However, the farmer has access to financing but through the traditional channels.

- In the case of new or alternative forms of financing, whatever the profile of the farmer, they must be more careful because there may be no public or bank entity that guarantees the operation. And in any case, conditions for payback or for participation of the investor will be there and they will have to be fulfilled.

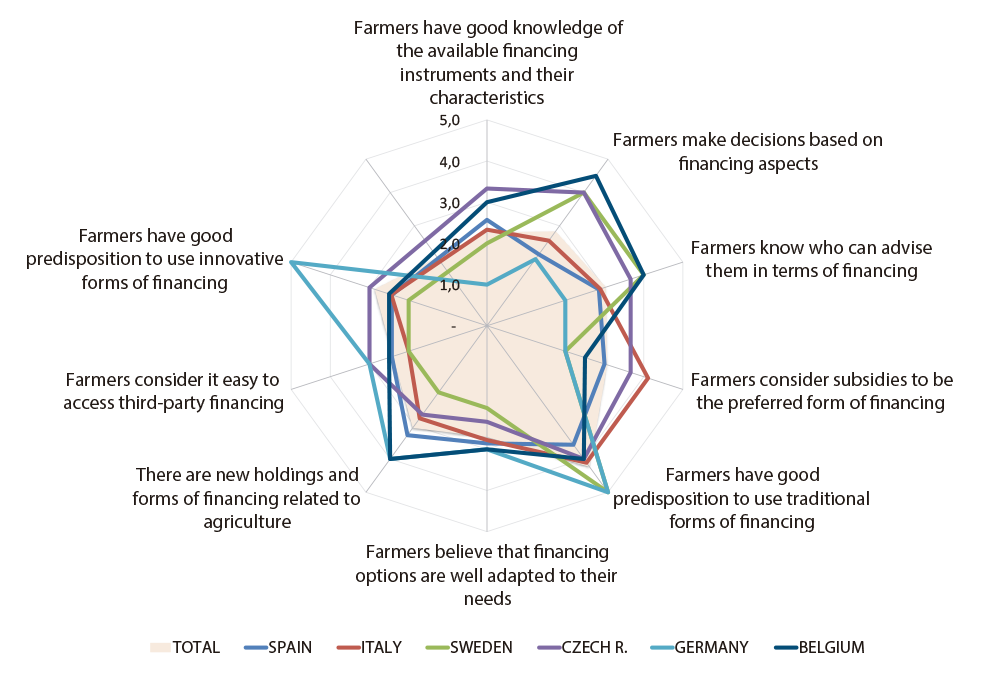

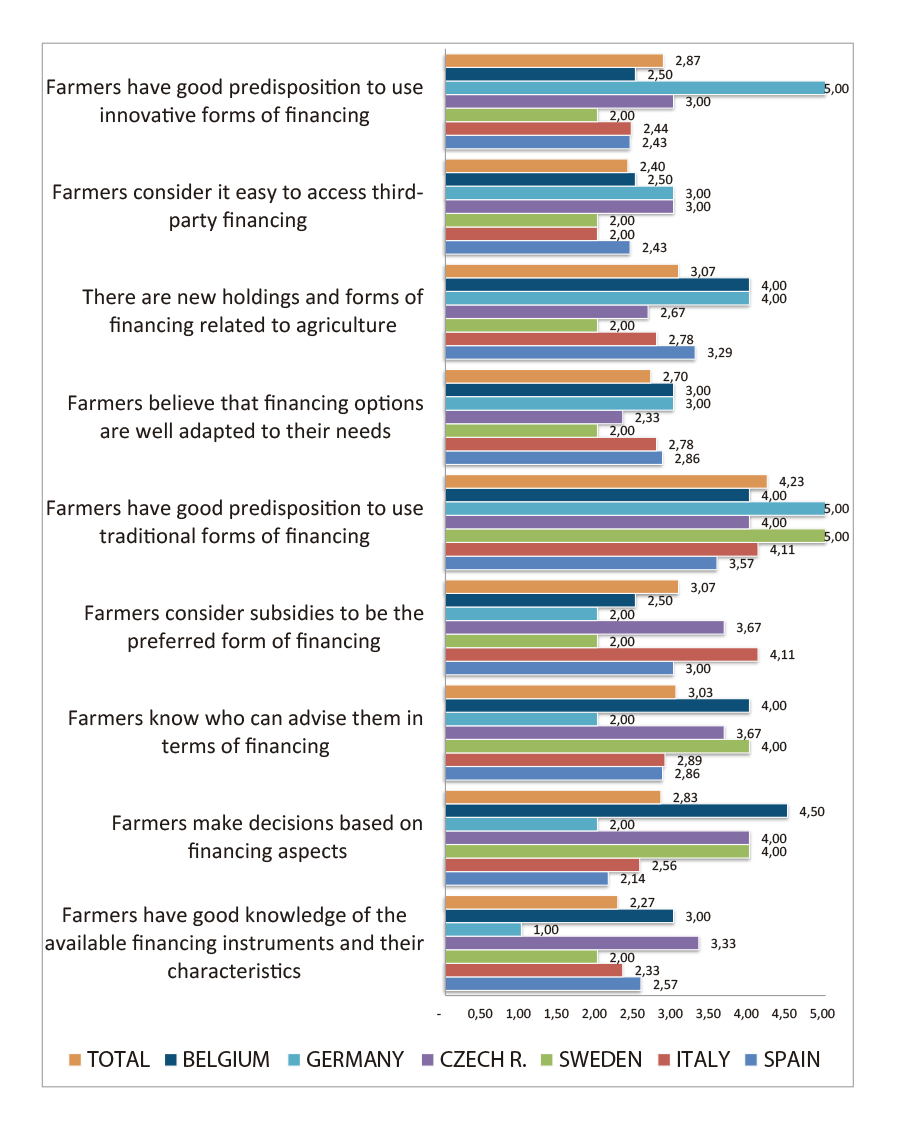

- In general, knowledge of financial instruments is quite low in the agricultural sector (2.27/5), with GER recognizing this most clearly. Perhaps this is because it is one of the countries most accustomed to using third-party financing, and therefore knows best the difficulty of financial supply.

- BEL, CZR and SWE indicated that farmers make decisions based on financial criteria, while the rest of the countries believe that other criteria are more important for the decisionmaking processes (3.03/5).

- With the exception of GER, all countries have a rough idea (3.07/5) of where to access for financial advice, with BEL, SWE and CZR again being the best positioned in this regard.

- There is some disparity with respect to subsidies as the preferred form of financing. While ITA and CZR have a high preference for subsidies, SWE and GER disagree. One explanation may be that SWE and GER have greater purchasing power, so the amount of subsidies are not sufficient to cover the volume of investments required.

- Farmers still prefer traditional forms of financing (4.23/5), especially in GER and SWE with ratings of 5/5, followed closely by BEL-CZR-ITA with 4/5, and finally with ESP 3.5/5 because they prefer cooperative forms of financing. Despite this, the financial products are not perceived as correctly adapted (2.7/5) to the needs of the agricultural sector. And new and more innovative forms of financing have not clearly reached many farmers (3.07/5), only BEL, GER and SPA show a greater preference for them (>3/5).

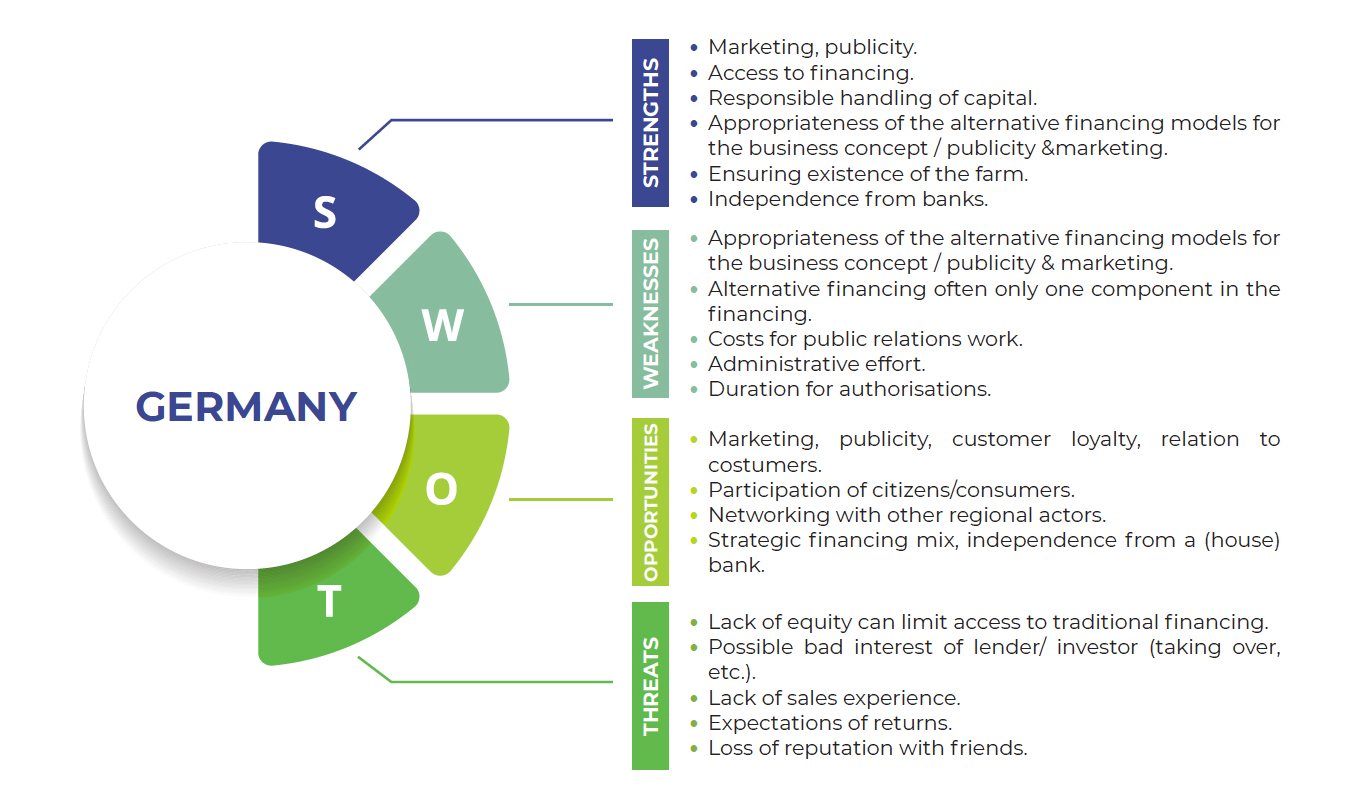

- In general, access to finance does not seem to be easy (2.4/5), even in countries more accustomed to financing with external funds such as GER (3/5). The new forms of financing have not fully reached farmers, which is the reason they may not be predisposed to accept them (2.87/5), only GER shows a positive attitude (5/5).

Financial aspects do not seem to be the main criteria for decision making, so there is not much knowledge of concepts and products, nor of those who can help farmers with this. Some countries prefer subsidies as their primary financial tool. For the countries who cannot rely on subsidies, exploring alternative tools such as the well-known traditional forms of financing, or the new innovative forms, may provide new opportunities for farmers.

II Knowledge and financial needs (bar chart)

Workers in the agricultural sector in general do not have formal professional training, this does not limit their production but their capacity to adapt to the challenges of the future. That is why training in this sector is vital today.

Nowadays, professionals are accredited with degrees in Agronomy or Agricultural Vocational Training. It is also possible to manage a farm with courses for access to start-up grants for young farmers. But it is also important to acquire other knowledge, competences, and skills.

FINANCIAL MANAGEMENT KNOWLEDGE

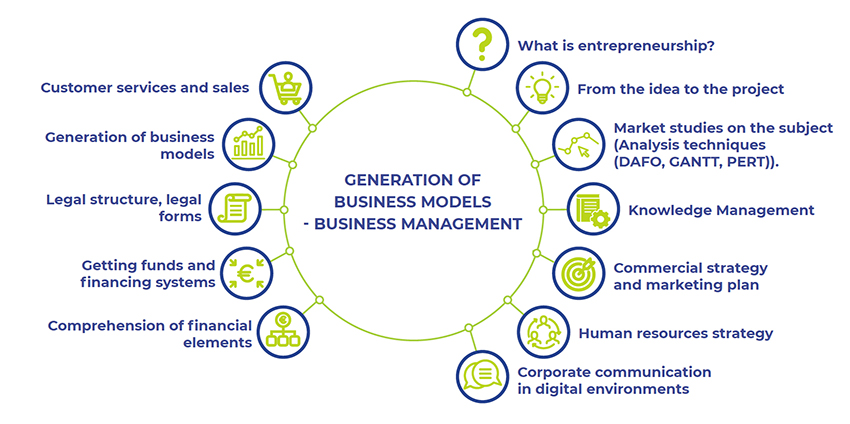

GENERATION OF BUSINESS MODELS- BUSINESS MANAGEMENT

INNOVATION MANAGEMENT

SKILLS AND COMPETENCIES

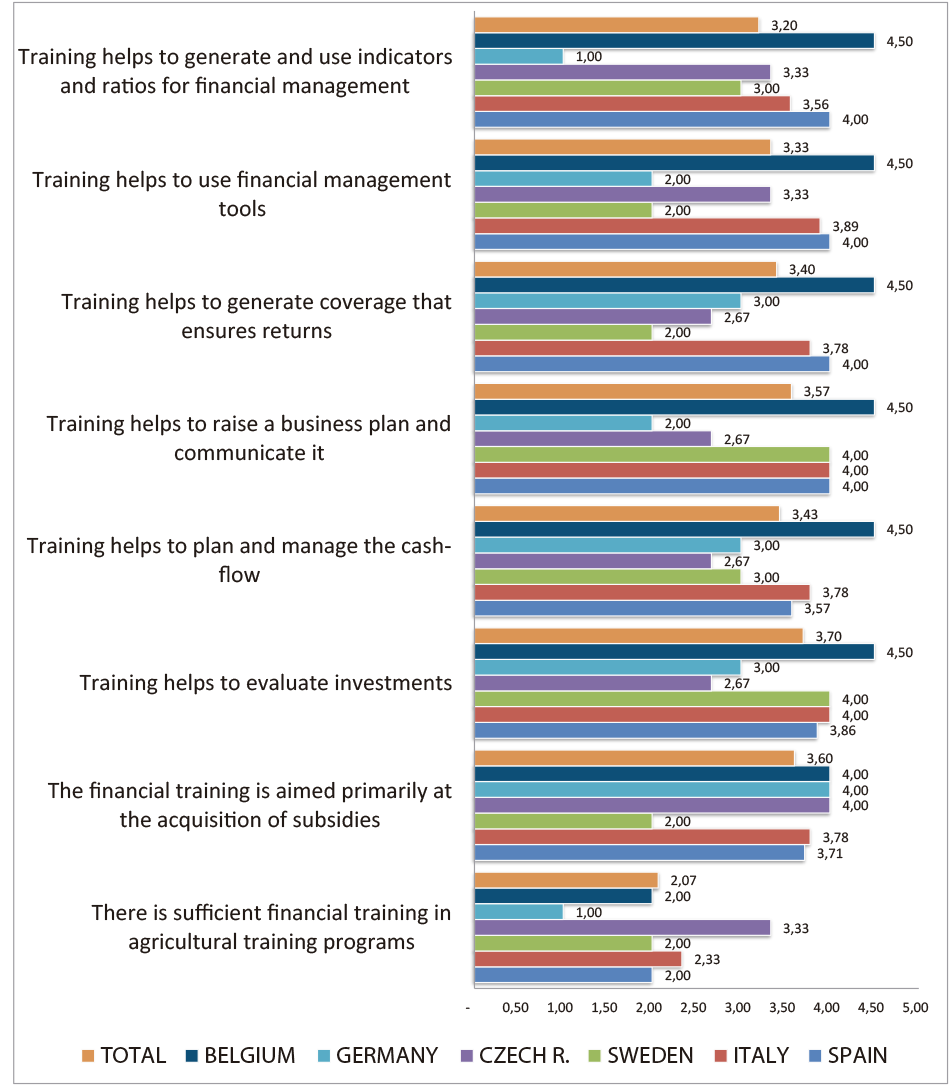

- Financial training in agricultural training programmes seems to be insufficient (2.07/5). This is the worst rating in the entire survey. With the exception of CZR (3.5), the rest of the countries show a significant deficit in this area.

- Overall, existing finance training programmes are usually aimed to (3.6/5) help farmers obtaining subsidies (Young Farmers, Modernisation, etc).

- In addition to helping farmers obtain subsidies, trainings help to improve the evaluation of investments (3.7/5), create and communicate business plans (3.57/5), manage cash flow (3.43/5), create coverage to ensure returns (3.40/5), handle financial management tools (3.33/5) and create ratios for management (3.20/5).

For all these reasons, it seems appropriate to improve formal training, agriculturalvocational training, agricultural university education or training for adults in the field of work. This will improve skills and abilities in financial management of farms, improving knowledge of financial concepts and products, and bringing together alternative forms of financing to facilitate access to them for all European farmers. Achieving all these objectives being the ultimate goal of this project.

III Farm financing training in your country (bar chart)

How to Write Nursing Papers

Students find nursing papers challenging. Although writing a nursing paper may appear daunting but they are essential for graduate school applications. Here are some suggestions for writing a nursing paper. Following these steps will ensure that you write a top-quality paper that reflects your academic level. Once you’ve mastered the structure, quality improvement paper nursing examples you can move on the more difficult parts of your task.