Duration of the module: 3 hours and 30 minutes

In order to obtain financing for a project, either through traditional financing channels (banks and financial institutions) or through the new financing tools studied in the FARMINFIN Catalogue, you will have to develop a Business Plan as a basic document to be able to sell your project, and its viability, to potential investors.

This module provides you with a guide to the elements that should make up your Business Plan, explores you the questions you should ask yourself and which area plans you should develop in order to give an overview of your project, the necessary means and the expected results.

Although it is common to focus on financial aspects as the basis for justifying the viability of the project, a proper prior analysis of the market, the environment and your company will be essential to give consistency to all the operational plans shown in a business.

We hope that all the information and concepts offered in this module can help you to develop a Business Plan that will facilitate the identification of opportunities and enable you to obtain the financing you need.

This module aims to provide you with the necessary knowledge to develop a Business Plan:

- For that, it is essential to carry out a detailed analysis of the environment, market and your SWOT analysis.

- From here you will be able to develop the different operational plans that meet your business and investment plan, this will configure the framework of your strategy, objectives and their implementation in the different areas of the business.

- Developing a correct marketing strategy, evaluating the necessary resources and estimating the economic and financial impact of these measures will be the fundamental tools to be able to promote your project to potential investors.

- Knowing and managing financial tools such as the Balance sheet, the Profit and Loss Statement and the Cash Flow Statement will be fundamental to justify the viability of your business and its long-term sustainability.

INDEX

1. What is a Business Plan?

2. Why developing a Business Plan?

3. Business Plan vs. Business Model

4. Business Plan Elements

4.1. Executive summary

4.2. SWOT analysis

4.3. Market analysis

4.4. Strategic Plan

4.5. Marketing plan

4.6. Sales plan

4.7. Operational Plan

4.8. Financial plan

4.9. Contingency plan

Conclusions

- The business plan is the document used to analyse, evaluate and present a business project.

- With the business plan, the different alternatives for carrying out a business are examined, evaluating the technical and commercial capacity (can it be done?), the economic-financial results (will we have the expected results?) and the obtaining of resources (do we have the necessary resources?).

- At each stage of its development (start-up, growth, maturity, etc.), the company requires different approaches and tools to achieve its objectives.

The Business Plan is extremely useful for:

- Defining the business objective using the right information and conducting the right analysis.

- Use it as a sales tool, in all types of relationships (e.g. with teams, banks, investment companies, etc.)

- Perform an in-depth analysis of the strengths and weaknesses to be found.

- Design a forecast of future results and needs.

- Integrate the objectives of the company.

Basically, the business plan is an essential instrument for analysing the viability of the company. The business plan has two fundamental objectives:

- Define the opportunity (future reflection)

- Promote your plan

- The executive summary is the summary presentation of a business plan. It consists of a summary of the most important points of the plan.

- The summary is prepared once the plan has been finalised and serves as a “letter of introduction” used to present the elements that make up the business plan in a summarised form in different forums.

- The aim of the executive summary is to provide the target audience with an overview of the project, so that they understand what the business consists of and how it is developed. It aims to generate interest in the business plan.

- The importance of the executive summary lies in the fact that it represents the key for the reader to become more deeply interested in the project. It is the on/off button to move forward.

Structure of the Executive Summary:

- The description of the business: What the business consists of, what product or service that we are going to offer, what are its main characteristics, what is the business model.

- The potential market: Quantify the possible market.

- Distinctive competence: How we differ from our competitors. What is it about the product or service that makes it different and better than the competition.

- Competitive advantages: the aspects in which we will have an advantage over our competitors.

- The reasons that justify the business proposal: The reasons why the idea is considered a business opportunity. What is the market situation, what unmet needs exist, what problem does our product/service solve, what improvement does it bring, etc.

- The business objectives: The business objectives over a three- or four-year horizon.

- The strategy: What will be used to achieve the objectives.

- The team: The people who will manage the project.

- The financial data: A summary of the financial data with a three- to four-year horizon.

- The resources needed: Especially the investment needed both with own resources and external resources.

A SWOT analysis is a strategic method used to identify the Strengths, Weaknesses, Opportunities, and Threats. SWOT identifies the internal and external factors that are favorable or unfavorable to achieve our farm or marketing objectives. Identification of the SWOTs is essential because subsequent steps in the process of marketing planning can be derived from the SWOTs and some goals could be set based on the SWOT analysis.

So far, we have analyzed external elements to the company that can offer us opportunities or threats for which we must be prepared for our marketing plan. But we must also know internal aspects may have a positive (strengths) or negative (weaknesses) impact on our marketing plan. In this sense, we must reflect on those areas of our farm that can impact on it. Among these areas we must consider production, management, finances, logistics capacity, team of workers, etc. From a deep study of our farm, we can identify the strengths and weaknesses we have as a business.

It is essential that the aspiring company or the operating company makes a prior analysis of its objectives and capacities. This is the analysis of the business opportunity. To analyse the business opportunity, the first step is to carry out an in-depth market analysis, for which we will study:

It is essential that the aspiring company or the operating company makes a prior analysis of its objectives and capacities. This is the analysis of the business opportunity. To analyse the business opportunity, the first step is to carry out an in-depth market analysis, for which we will study:

- The market.

- Customers and their needs.

- The competition.

- Our resources.

- The business opportunity.

Market research allows the company to know the market where it is going to offer its products and services.

Market research, properly conducted, helps to determine the demand and to know the quantitative and qualitative aspects of it.

Studying the market allows us to understand it and with this knowledge to develop one’s business strategy.

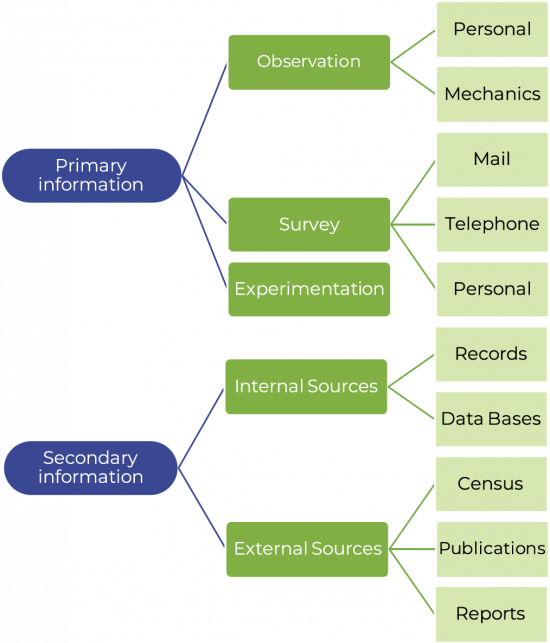

There are two types of information in market research: primary and secondary information.

- Primary information: information that is necessary for a specific purpose (e.g. Development of the business plan). It is obtained through fieldwork.

- Secondary information: information that already exists somewhere (e.g. bibliography, internet, databases, etc.). It is obtained from official organisations, companies, newspapers, libraries, internet, etc…

It is necessary to study the behaviour of consumers /customers to detect their consumption needs (type of products/services they need, why they need them, etc.) and to find out about their purchasing habits (places of purchase, time, etc.). The objective of the analysis is to have information that allows us to know the customer’s unsatisfied needs, their preferences, etc.

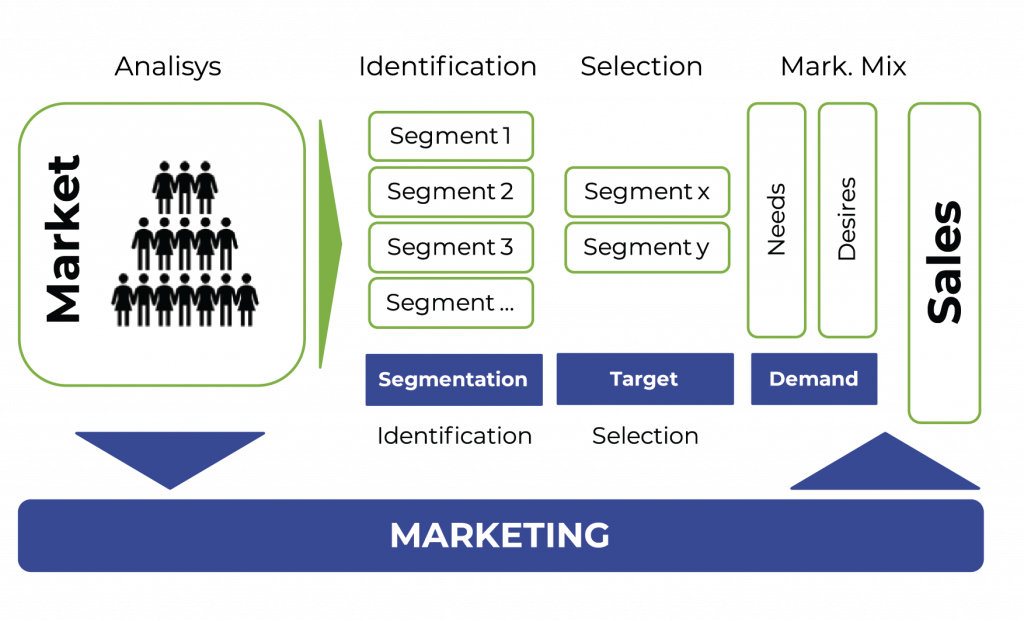

Sometimes we are not interested in operate in the entire market and will try to reach out to specific groups within our market. Therefore, it may be interesting to divide the potential market into segments, i.e. homogeneous groups with similar characteristics. Examples of specific targets: groups of people with a high purchasing power, families with children, people who are sporty and/or concerned about their health, catering companies.

It is necessary to carry out a study of the client or consumer in order to answer these types of questions:

- Who are they?

- Why do they buy?

- How do they buy?

- Where do they buy?

- When do they buy?

- How much do they buy?

- How often do they buy?

- What do they think?

- How do they perceive the products or services?

- What are their weaknesses?

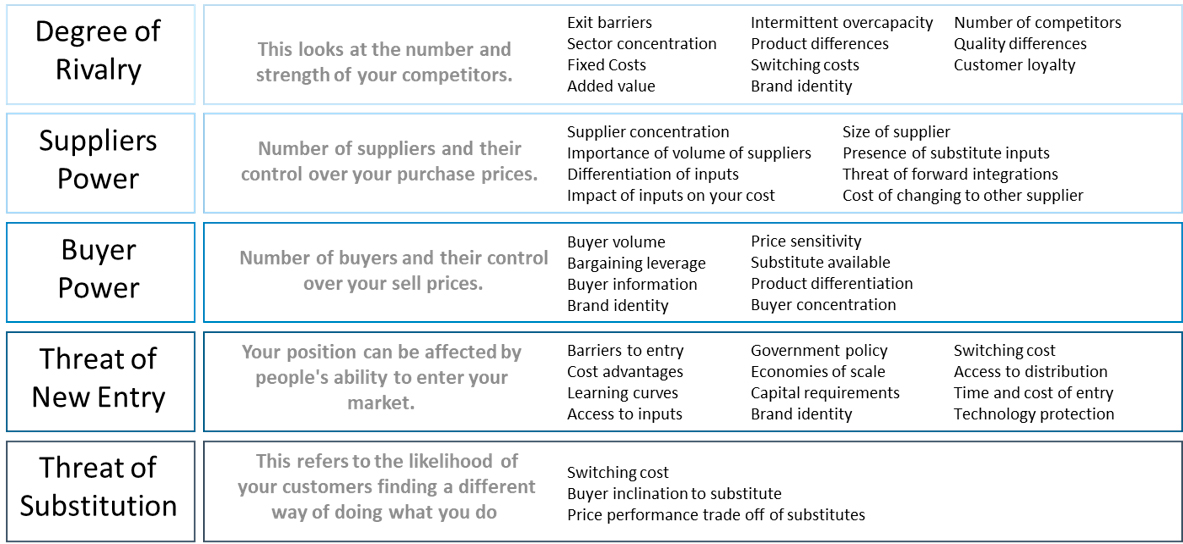

Michael Porter acknowledges that organizations are likely keep a close watch on their rivals, but he encouraged them to look beyond the actions of their competitors and examine what other factors could impact the business environment. Porter identified five forces that make up the competitive environment (market).

The following questions should be addressed:

- Who are my competitors?

- What products or services do they offer?

- What is their differentiation strategy?

- What is the market share of your competitors?

- What is their pricing policy for their products or services?

- What substitutes are likely to appear?

- What are the trends in the sector in the coming years?

- How can the competition react to the entry of another competitor?

Porter´s Five Forces

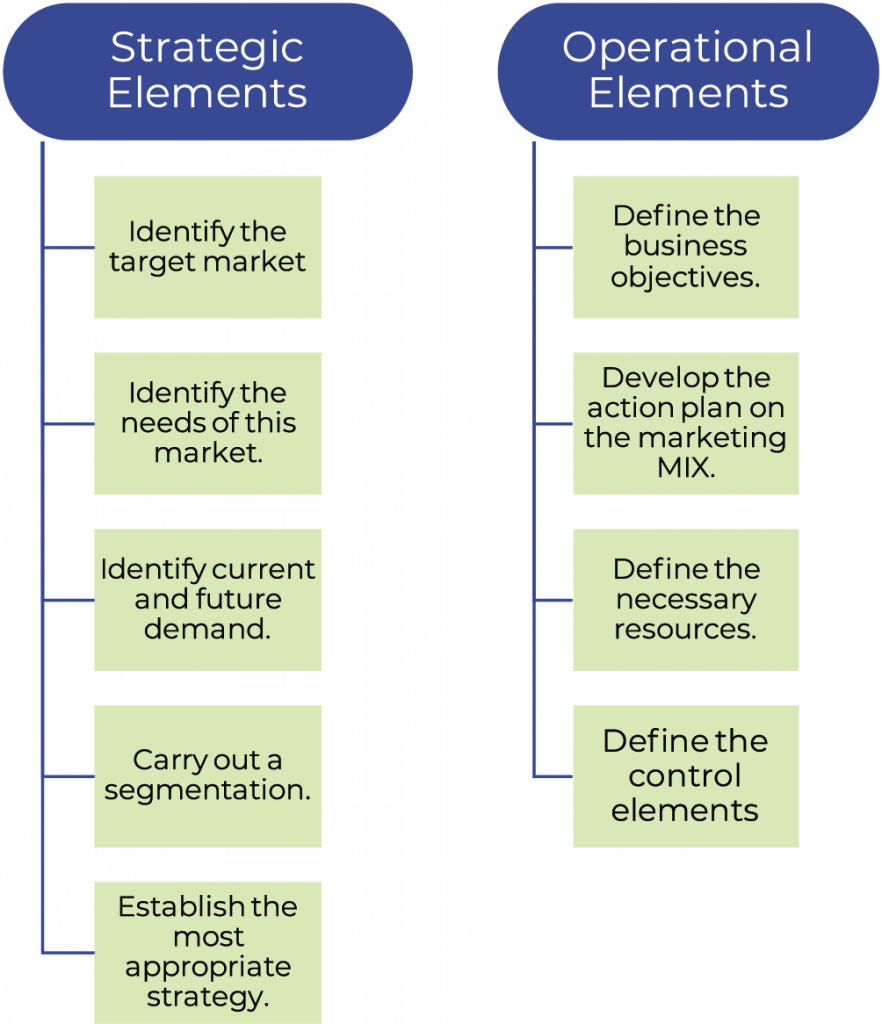

Companies, like people, must have a purpose and a personality that define and differentiate them from other people. In the case of companies, this is established through the definition of a strategic plan, in which their missionvision-values must be described, and objectives are established to achieve them.

The strategy must be understood as a business plan that seeks to exploit your competitive advantages in a way that allows you to differentiate yourselves from your competitors, taking advantage of your business strengths, with the aim of creating greater value for your customers.

The STRATEGIC PLAN is proposed at a company level in the long term, but each area of the business must contribute to the fulfilment of the objectives under the premises established in its mission, vision and values.

What does the strategic plan contain and what questions does it answer?

- What is our reason for being? – Our mission.

- Where do we want to go? – Strategic vision.

- What do we do well? – Distinctive competence.

- What do we want to do? – Strategic objectives.

- What do we want to achieve? – Overall objectives.

- How do we get to that future? – Action plan.

Once defined the business and objectives it is necessary to design strategies. Marketing offers 4 basic instruments for this purpose. These 4 elements are the variables known as the 4 Ps for the first English letters of each of them: Product, Price, Place, and Promotion.

These variables are usually controllable by the company, but in SMEs they will only be relevant if we carry out our own marketing in which we can maintain some power in the market.

- On the one hand, the product and placement are strategic elements that can evolve but usually have a long-term permanence.

- On the other hand, price and promotion are tactical instruments that can be easily changed if we have control over them.

From the perspective of the buyer, these 4 Ps become 4C:

Product Customer ➜ Value

Price ➜ Cost

Place ➜ Comfort

Promotion ➜ Communication

Marketing Plan (Product)

- Our product will be any good or service that can meet the needs of our target audience (customer-buyer). In this sense, we should not only focus on the characteristics of the product, but also on the benefits it generates, as well as the feelings for the consumer.

- An individual who buys an organic product, besides the need to eat, is usually looking for a healthy product, which also satisfies the need for safety and tranquillity offered by such a product. From our perspective, we must consider which values or needs can be covered by the purchase of our products (e.g. explore our capacity to generate experiences, link between the purchase of our products to emotional needs of the users, link them to us in the long-term (loyalty).

- In addition to these concepts, the product also consists of other aspects such as quality, design, brand, services, financing, warranty, etc. To define a product, we must take all these into consideration and not meet a simplistic criteria. All together these features generate a perceived value which makes each potential customer decide to buy or not for a specific price.

- The set of different products that we put on the market determines our portfolio of products. We must decide on their complementarities, homogeneity, and the way in which we will group them (Will they be sold in a grouped or individual way?).

- Once we defined the characteristics that distinguish and identify our products, we have differentiating products. This must be then one of our competitive advantages. The ways to differentiate are multiple, you can differentiate according to quality, price, design, image, services, etc. In our case, the fact of supporting specific groups, differentiates us from other traditional products that do not provide that differential value.

- Aspects that we must develop are the brand, the shape and the packaging, which will facilitate the recognition of the product, while allowing differentiation of products and generating a positive image towards the product and the company.

To reinforce our competitive position, we must thrive to provide our products with all the differentiating elements possible, in this way we will have a stronger product and we can reach out to more types of customers.

The brand is an intangible value linked to the product, incorporating cultural and emotional values. Differential elements are those that are associated with the brand generating an emotional bond with the product.

We have already talked about positioning, which is the place you occupy in the mind of the consumer in relation to other products on the market. It will depend to a large extent on all the differential attributes that we have associated to our product, and will determine the degree of preference of a consumer towards our product.

Knowing our position, is relevant to maintain or correct the position we have in the mind of the consumer, there are several ways to position one’s products:

- According to product characteristics

- Related to benefits or problems they solve

- In terms of type of use made

- By the class of users who access the product

- How it relates to other products of the same class or other classes

- So that it differs from other products of the same class

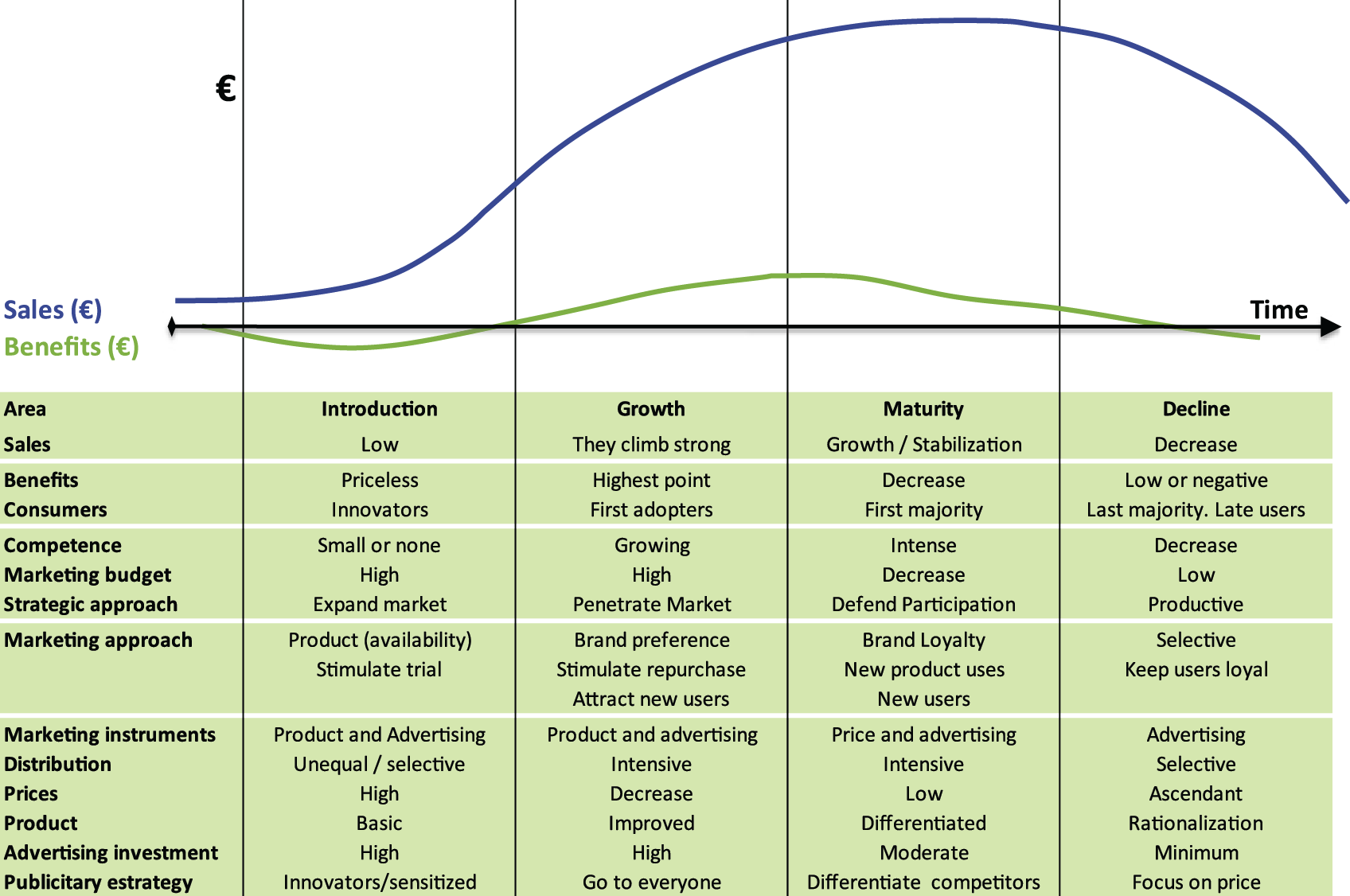

Product Life Cycle is a relevant concept as it tries to picture the behaviour of a product in the market taking inspiration from biological phases. In this way, the evolution of a product can be explained from its launch to its disappearance. In this sense, 4 phases are defined: introduction, growth, maturity and decline. These phases are associated with the evolution of sales and profits. The Product Life Cycle is a standard way to analyze the evolution of a product, the behaviour of consumers and marketing or competition strategies.

Marketing Plan (Price)

The classical economic theory establishes that when a price falls, the demand tends to rise and vice versa introducing at the same time the concept of elasticity: if the demand growth is greater than the price decrease, the demand is elastic and if this does not occur it is inelastic.

The elasticity depends not only on the type of product but also on the type of consumer. The price for marketing is the monetary value that the buyer is willing to pay for a good that meets their needs (utility) and that the seller is willing to sell to cover his/her costs and commercial margins.

The unit costs, i.e. what it costs us to produce a unit of marketable product, determine the minimum price so as not to incur losses (profit/losses = income-costs). The maximum price will be determined by the price sensitivity of the different segments of buyers (the average price that a potential client is willing to pay). Therefore, the price-making decision must be made between these limits, conditioning the decision to obtain a rational unit margin that guarantees us certain profitability and on the other hand the competitive position of similar or substitute products sold by the competition.

The common pricing methods:

- The costs

- Competition

- The demand

You can find more information related to “Price” from a financial perspective in the “Financial aspects: basic knowledge and competences” module.

The cost method will allow us to set a minimum sale price, but normally in the market, large producers set prices that are usually the reference for the consumer and the rest of the producers are positioned above or below that price.

Our position when it comes to prices can be based on the differentiation of the product that justifies whether we are above or below the market leader. To respond to this differentiation of product/service (e.g. in terms of quality, availability, guarantees, etc.) 9 pricing strategies are possible.

Strategies marked with “X” in the table should not be taken into account, in the upper line we find a strategic position in which we offer better qualities, attributes and/or services than market leaders. Based on our cost structure, from our expectations of profitability and our commercial objectives, we will position our price above, below or on a equal basis.

The positions marked in grey would be those in which we differ in prices, always offering lower prices, knowing that we are equal or worse than our competitors in terms of product/service.

Marketing Plan (Placement)

Once we have determined the product that we are going to sell and the sale price, we have to determine where we are going to sell and how we are going to get the product to the final consumer. The distribution mission is to make our product available for purchase. In this sense, we have to consider several concepts:

- Sales force: it constitutes the set of sellers that a company has. It is important to develop personal sales and involve direct contact between the company and customers.

- Agents: third parties representing the products in exchange for consideration.

- Franchise: a form of collaboration between two companies. Under conditions fixed by a contract a company grants the other, in exchange for a quantity and conditions, the right to operate a brand, ensuring services and assistance for such exploitation.

- Intermediary: person or organization that purchases our products to sell them to another buyer (thereby obtaining a profit) and actively participating in the transfer of the product, which may affect the purchase and prescription process. The intermediary can be a retailer who sells to the final customer directly or a wholesaler who sells to other intermediaries.

- Distribution channel: Set of intermediaries through which a product passes from the producer to the consumer.

The types of distribution channels are characterized by the number of intermediaries who act between the producer and the consumer:

Marketing Plan (Promotion)

Marketing Plan (Promotion)

The promotion is based on communication to transmit information that stimulates the demand for the products to which it refers. Among the objectives of the promotion we have:

- Inform about the existence of the product, making its characteristics and needs that it covers known.

- Persuade about the benefits it offers and stimulate demand.

- Remember the existence of the product and its advantages, to avoid changing brands.

Within the commercial strategy, the company has to decide where its communication efforts are heading and whether to allocate those to the chain and the intermediaries (push) or to the buyers (pull).

- “Push” strategies: try to boost communication and resources to enhance the chain’s action, so that they are the ones who push sales. In this case, sellers, agents and intermediaries then are the sales pushers.

- “Pull“ strategies: try to boost and allocate the resources in the communication to the buyer so that they are the ones who go to the points of sale in search of the product. So here, the buyer pulls the sales.

Sales Plan

Note: Structure of the Annual Sales Plan, which can be downloaded in Excel format for use as a work template.

The Operational Plan includes the technical and organisational aspects necessary for the production of products or the provision of services.

In start-up companies, the plan can be very simple. But for specific investment projects that have an impact in this area in order to seek growth or efficiency, this section may have special relevance for financing justification.

The operational plan contains four elements: products and services, processes, production programme and supply programme and stock management.

Assets and Liabilities

The Economic and Financial Plan aims to measure a basic objective of any business, which is its profitability, without forgetting that there is a second objective necessary to be able to speak of viability, which is that of liquidity (cash flow).

In order to measure the profitability and liquidity of a business, we will rely on the management of certain financial documents that will be part of the Economic and Financial Plan. These documents are:

- The Balance Sheet. Which is constituted by the assets of the company and the means required to finance them or liabilities.

- a. Calculation of investment requirements. The initial investment of a company, from a technical point of view, is the company’s assets.

These assets include the goods and rights necessary to start the activity. - b. Financing of investments. Once we have calculated the initial investment volume to start up the company, we will have to determine how we will finance this amount.

- a. Calculation of investment requirements. The initial investment of a company, from a technical point of view, is the company’s assets.

- Profit and Loss Statement. A company turnover comes from sales, although there may also be extraordinary income (see Sales Plan). The structure of the Profit and Loss Account includes the classification of expenses and costs (differentiating fixed and variable costs).

- Cash budget. When analysing the viability of a company, it is necessary to make an analysis of the company liquidity, as a lack of liquidity can cause the death of a company. The cash budget records the company collections and payments.

These documents have been previously studied in module B “Financial aspects: basic knowledge and competences”, where the financial concepts necessary to face a Financing Project have been presented. In the present module we are going to list these documents and we are going to offer you an excel document in which we collect several templates so that you can use them in the elaboration of your Business Plan. These documents are of great importance for promoting your Business Plan. So, if you have any doubts on some financial concepts, please refer to Module B “Financial aspects: basic knowledge and competences”.

Balance Sheet

Your balance sheet offers a look at how much equity you have in your business. On one side, you need to list all your business assets (what you own), and on the other side, all your liabilities (what you owe). This provides a snapshot of your business shareholder equity, which is calculated as follows:

Assets – Liabilities = Equity

These documents have been previously studied in module B “Financial aspects: basic knowledge and competences, if you have any doubts you can go back to review contents.

Extended Balance Sheet

These documents have been previously studied in module B “Financial aspects: basic knowledge and competences”. For details, please refer to module B.

Note: The Structure of the Balance Sheet document can be downloaded in an Excel format for use as a work template.

Profit and LosS Statement

Your income statement is designed to give readers a look at your revenue sources and expenses over a given time period. With those two pieces of information, they can see the all-important bottom line i.e. the profit or loss your business experienced during that time. If you have not launched your business yet, you can set a forecast for information purposes.

EBITDA: Earning Before Interest, Taxes, Depreciation and Amortization (EBIT + Depreciation + Amortization).

These documents have been previously studied in module B “Financial aspects: basic knowledge and competences”. For details, please refer to module B.

Note: The Structure of the Profit and Loss Statement document can be downloaded in an Excel format for use as a work template.

Cash Flow Statement

The cash flow measures refers to the flow of money in the company, i.e. inflows and outflows. This flow does not coincide, in most cases, with the flow of income and expenses.

The profitability of a business is measured by the ability to generate profits, i.e. it is a consequence of the difference between the company’s sales and expenses.

The liquidity of a business is measured by the ability to meet all payments, and this is measured by the difference between collections and payments.

These documents have been previously studied in module B “Financial aspects: basic knowledge and competences”. For details, please refer to module B.

Note: The Structure of the Cash Flow Statement document can be downloaded in an Excel format for use as a work template.

Financial Ratios

During the development of the plan and its implementation, unexpected events may occur that change the working hypotheses with which the business plan has been developed.

To deal with these unforeseen future events, it is necessary to take into account which events are the most likely to occur and to develop an alternative plan (contingency plan) to limit or cancel their effects.

- Obtaining financial support is not easy, the requirements are often difficult to meet, but providing a clear and precise vision of your investment plan and your business project can be a great help in the process of obtaining financial support.

- The financial aspects are fundamental in a Business Plan, but carrying out a thorough analysis beforehand will give consistency and veracity to your projections and operational plans.

- You must have a clear idea of what you want (mission, vision and values), what you need and how you are going to invest all your resources to achieve your strategic and operational objectives.

- Making these aspects visible in the operational plans (Marketing, Sales, Operations, etc.) together with the development of economic and financial projections should be the basis of your Business Plan.

- Know the concepts, work on them and use them as tools to give shape to your project idea, but always taking into consideration to who you are going to address it. With this aim, it is also essential to know how to communicate it.

- De la Vega, I. The Business Plan: An indispensable tool. Business Institute.

- Barrow, Colin Barrow, Paul Brown, Rober. The Business Plan Workbook. Kogan Page.

- Coke, Al. How to create a successful business plan: a manager´s step-by-step guide. Amacom.

- Johnson, Ron. Perfect Business Plan. (Century/Arrow)

- Santesmases Mestre, Miguel. Fundamentals of Marketing, Ed. Piramide.

- Santesmases Mestre, Miguel. Marketing, Concepts and Strategies, Ed. Piramide.

- R. Alonso Sebastián. Agrifood Business Economy. Ed. Mundiprensa.

- Ballesteros, Enrique. Agricultural and Food Business Economics. Ed. Mundiprensa.

- Kotler, Philip. Broadening the Concept of Marketing. Journal of Marketing. 1969.