This case study is about AnnelövsGrisen AB, a pig farm located in Sweden where Cissi Klasson, the CEO and farmer that we interviewed, raises piglets up to 30 kg to sell them to a finisher producer for meat production.

After being employed as production manager at AnnelövsGrisen AB, Cissi took over the farm thanks to the financial help of a business angel and of an investment fund.

She is co-owner, CEO and farmer with multiple responsibilities including taking care of the piglets, managing production and staff as well as supervising the financial and administrative aspects.

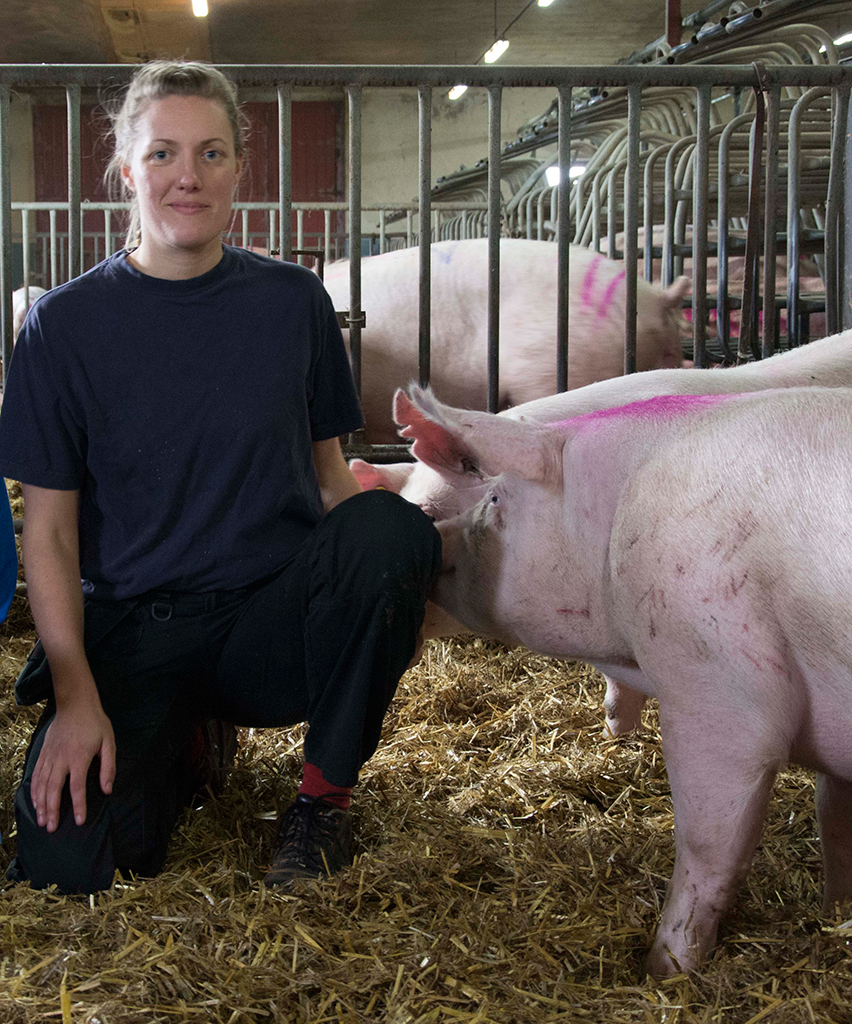

![]() Name: Cissi Klasson.

Name: Cissi Klasson.

![]() Birth year: 1990.

Birth year: 1990.

![]() Gender: Female.

Gender: Female.

![]() Education: CISSI has a Bachelor’s in agriculture and rural studies with a minor in Economics.

Education: CISSI has a Bachelor’s in agriculture and rural studies with a minor in Economics.

![]() Occupation: She is the CEO of AnnelövsGrisen AB, a pig farm where they raise piglets. She takes care of the piglets and supervises production, employees as well as the financial and administrative aspects. She is a full-time farmer, without external sources of income. She works 60-70 hours a week at the moment, taking into account the Covid-19 situation.

Occupation: She is the CEO of AnnelövsGrisen AB, a pig farm where they raise piglets. She takes care of the piglets and supervises production, employees as well as the financial and administrative aspects. She is a full-time farmer, without external sources of income. She works 60-70 hours a week at the moment, taking into account the Covid-19 situation.

![]() Farm location: In the South of Sweden, closed to Malmo.

Farm location: In the South of Sweden, closed to Malmo.

![]() Farm Area in ha: The farm is 15 hectares in area with the pig stables which covers a 9-hectare area.

Farm Area in ha: The farm is 15 hectares in area with the pig stables which covers a 9-hectare area.

![]() Farm description: AnnelövsGrisen AB is a company with profit objectives owned by Cissi. The farm raises small pigs (with a weight of about 30 kgs) for meat production. The piglets are then sold to a finisher producer that fatten them from 30 kgs up to around 120 kgs.

Farm description: AnnelövsGrisen AB is a company with profit objectives owned by Cissi. The farm raises small pigs (with a weight of about 30 kgs) for meat production. The piglets are then sold to a finisher producer that fatten them from 30 kgs up to around 120 kgs.

The farm that Cissi now owns has a long story, with many owners succeeding one after the other since the 1950s. Before Cissi took over the farm, AnnelövsGrisen AB was owned by two neighbour farmers.

Cissi started to work 2 years ago for them as production manager, and she came to know that the farm was going to be put on sale.

Cissi’s pig farm does not have multifunctional activities (except hosting trainee students from college). Cissi does not work with family members, but she has a business partner – a veterinarian who became her business angel, who supports her but does not work operationally at the farm.

Cissi has 10 employees, 7 of which work full-time on the farm.

Cissi started working as a production manager on the farm, AnnelövsGrisen AB, that she knew was on sale.

She became interested in buying it. She found Tillväxtbolaget, a risk capita company made for farm investments in Sweden which suggested her to find another financial partner in order to collect more money for her project and make her investment safer.

Eventually she found Simon, her business companion, a veterinarian who lent her 4% of the purchase price and invested as much money for himself as a co-owner. He didn’t want to be an operational manager and stay at the farm. He became her business angel.

Then, Tillväxtbolaget invested in the farm retake an extra €400 000 and Swedbank paid the rest which includes both purchase price and taking over the old loans that the company already had.

AnnelövsGrisen AB represents 2 type of innovative finance: Business Angel (Cissi’s business companion) and Investment fund (Tillväxtbolaget).

According to Cissi, having a business angel offers great support; however, the hardest aspect of it is the relationship: ‘You have to learn to know each other. He is not a lay-back business angel, he wants to put his fingers sometimes here and there and give advice.”

The hardest aspect of having an investment fund is the interest rate and the short pay-back time.

In general, she would strongly advise farmers to use those forms of innovative finance.

Cissi receives management counselling about pig production and can count on the support of external veterinarians.

Cissi pointed out that the main positive outcomes from accessing those funding were: risk reduction, increase in income, satisfaction of personal concerns, advantage over the competitors and job creation.

Cissi is involved in many networks such as pig production managing groups, the Southern Swedish pig producers and LRF (young farmers association).

Cissi has several plans of growing her company in the next 5-10 years. She is considering either building a new stable or doubling the size of her current stable and keep on selling small pigs. Moreover, she wants to reduce the mortgages from the banks/investment fund and stabilise financially.

If she is going to build a new stable, she is planning to search for funding. She will start to look for help from the investment fund. If she decides to double the size of the current stable, she will ask financial help to the slaughterhouses.

As far as smaller investments are concerned, Cissi is now looking for ways to finance the transition to a more energy-efficient use (ventilation changing).

“Back up a bit, take a helicopter perspective and be honest with yourself: do I really want to do this? Can I do this? What’s my good and what’s my bad?”

It is important to make an honest assessment of the project and your needs. “I do this because this is important to me, this is really me. You have to look at yourself: do I want to work alone? Do I want to make money? Is it more important for me to live in the farm and have my job right outside my door?”

![]() Training experiences and gaps: Cissi didn’t receive any specific training related to farm management.

Training experiences and gaps: Cissi didn’t receive any specific training related to farm management.

In her opinion, an essential aspect to manage a farm is to have a good attitude: you can be competent and have adequate knowledge but if you don’t have a good attitude to your employees or to yourself – forgive your workers or yourself if they/you are wrong – you can have issues.

“The workers are my focus. I don’t have to know everything or be good at everything. I have to make sure that I give my employees credit when they perform well. I want them to feel that I trust them”.

![]() Final considerations: This case study offers insights on a mixed innovative finance model for a pig farm. Cissi would not have been able to take over AnnelövsGrisen AB without the financial support from her business angel – a veterinarian whom she didn’t know before and with whom the relationship is not always easy – and an investment fund – Tillväxtbolaget, which supported Cissi since the beginning in her project of taking over the farm and offered financial help and advice.

Final considerations: This case study offers insights on a mixed innovative finance model for a pig farm. Cissi would not have been able to take over AnnelövsGrisen AB without the financial support from her business angel – a veterinarian whom she didn’t know before and with whom the relationship is not always easy – and an investment fund – Tillväxtbolaget, which supported Cissi since the beginning in her project of taking over the farm and offered financial help and advice.

Cissi Klasson mirrors the spirit of a businesswoman and farmer: she has an entrepreneurial and learning attitude, likes to take risks, is aware of the importance of having a good attitude towards her employees and is involved in several networks to exchange practices, contacts and get visibility.