and solving, identifying needs related to financing

Duration of the module: 45-60min | Duration of each unit: 15-20min

Interest in the agricultural business among (not only) young people has grown in recent years and many new small farms, shops, and products are emerging. From the business management perspective, the field of agriculture is the same as any other, although it has its own particulars. Thus, as in any other business area, it is essential to thoroughly prepare your business plan (project) and determine whether it is feasible, justifiable, and viable.

This module aims to guide you through several areas necessary when starting a business or a new project in agriculture. The main learning objectives of this module are:

- The earliest stage of your business – the idea itself.

- Classification of your ideas and converting them into a more organized form – a business plan.

- Problems in the initial phase of business, recognition thereof and possibilities for their successful solution.

- Business opportunities, what methods can be used to identify and evaluate them.

- The economic aspects that affect your business and principles of financial decision-making.

- The common agricultural policy and other funding options.

INDEX

1. Building a business idea

1.1. Business motivation

1.2. Introduction to business plan creation

2. Problem setting and solving

2.1. Business opportunities

2.2. Project evaluation

2.3. Economic aspects of agricultural business

3. Identifying needs related to project financing

3.1. Financial decision-making

3.2. Common Agricultural Policy

3.3. General financial possibilities

3.4. Other financial possibilities

An entrepreneurial idea is an idea that can be turned into a business. If you do not have an idea yet, focus on what area you would like to do business in and what services you can offer. Successful business ideas are often based on a simple central idea. Do not look for complicated things.

- Write down your business idea the moment you start thinking about it. The idea is often unstructured at the beginning, full of messes, shortcomings, but also many interesting details that can be forgotten later.

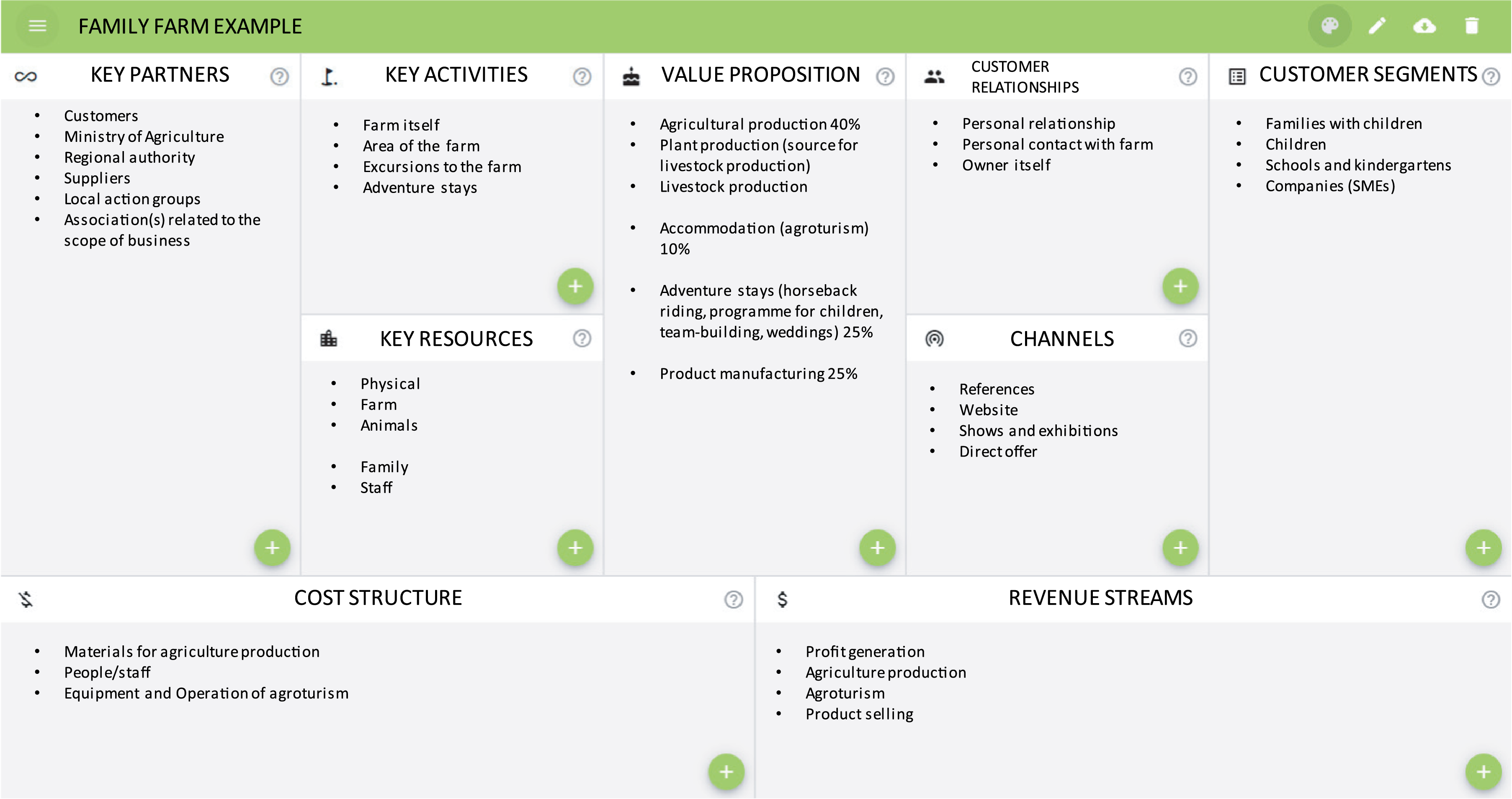

- Start to organize and structure your idea. Prepare a summary of your business idea for yourself. One of the popular methods is Business Model Canvas – a one-page document with nine predefined building blocks, which will be described in detail in a separate module.

- When you have an idea, start concentrating on the “why” and “who”.

- Why is it a good solution/product?

- For whom would it be a good solution/product?

CANVAS

TIP! You can try to think about your Business Model Canvas in advance. All fields are editable. Then you can compare your knowledge in this field before and after going through a specific module dedicated to BMC.

Source: BMC Tool (free online app) https://www.app.business-model-canvas.app/#

STEP 1 – What drives you on? Think about it. Before you start an agricultural business, understanding your own motivation will be worthwhile from a long-term point of view.

STEP 2 – Think about your personal situation and business environment.

- Do you need some specific or additional education for your business?

- Are there local support or advice institutions that you could work with?

- Are you aware of any obstacles in the development of your business?

STEP 3 – Establish your goals and objectives.

- Identify the values that are most important to you.

- Write down your goals and what you want to achieve with your business. Remember that your goals should be measurable. Without the possibility of measurability, it will be difficult to assess and determine whether you are on the right path to achieving them.

- Write down your “dream plans”. These plans are likely to change over time, but it’s good to go back to the very beginning from time to time.

The business plan is the cornerstone of a new business. However, it does not matter if it takes up 40 pages or if you can fit it briefly on 2 pages.

Its structure, purpose, and especially its content are important.

The main idea of a business plan is to sort out:

- Where are you right now?

- Where do you want to go?

- How do you get there?

- Why do you want to do it?

Although it may seem that in today‘s dynamic world of business and start-ups even in agricultural business, a business plan is outdated, it is difficult to avoid (e.g. when applying for a loan, entering a crowdfunding portal, or meeting with an investor).

There are many freely available patterns on the internet and they are often slightly different. For more information on how to write a business plan, examples, and templates you can find an example here.

In the following two slides, we will focus on 6 basic questions that will accompany you while you are working on your business plan:

- Why is the project created and what do you expect from it? Always start with the question: “Why?”. Determine what makes sense for you and where you see your project in a few years. In other words, you should define your mission, vision, and strategic goals.

- Who is the customer and why will the project succeed with him/her? Determine who your customer is, what his/her needs and problems are and what solutions you offer him/her (“value proposition”). Then find out how many such customers there are (market potential) and who is the direct and indirect competition. It is important to know why a project has a chance to succeed, and whether you are entering an already occupied market or creating a completely new one.

- How will you make money? What value do you create, what activities await you (e.g. research, production, sales, marketing), who will carry out these activities, how will the product/service reaches the customer,…

- What needs to be done and when? Medium and short-term milestones need to be set on the path to long-term goals. When you write down the individual activities and the timeframe that will lead you to these goals, you will get the first draft of an action plan.

- Where do you get the resources? Transform the action plan into a financial plan that shows when you will spend what and what revenue the project will generate. From the financial plan, you can deduce how much money you need at the start of the business project and how much you should aim to earn per year.

- Who is behind the project? What kind of people hold added value for the project and what are their conditions for successful implementation? It is not just about your experience, knowledge, and skills, but also the motivation with which you enter the business in the field of agriculture.

Problem setting (defining a problem) is the first step to successfully solving it. Defining and solving known problems should even precede the creation of a business plan or other models (such as a Business Model Canvas).

This attitude will help save more time in the problem-solving phase since the problem is well-defined and foreseen. It also enables a reduced waste of initially invested resources.

Problem-solving is an integral part of every business. Unfortunately, this process is often only intuitive. Following a systematic approach or set of problem-solving strategies can prevent you from acting rashly and making decisions that are not in your best interests or the best interests of your customers or investors. You should also master these skills before choosing your problem-solving method:

- Using emotional intelligence – Act calmly and recognize your emotional patterns (avoid hasty reactions and conclusions)

- Researching problems – Effective solutions require an accurate description of the problem. Complex issues require more detailed research, such as data surveys or interviews.

- Creative brainstorming – When brainstorming with a group, listen carefully and accept the opinions of others, although you do not have to agree with them personally.

- Decisiveness – Use an agreed system of decision-making which may include assigning the pros and cons of solutions, selecting decisionmakers, and completing or repeating the process.

Solving business problems works best when they are approached through a consistent system.

An example of a consistent procedure might be the following:

- Identify and define the problem

- Prioritize the problem based on size, potential impact, and urgency

- Complete a root-cause analysis

- Develop a variety of possible solutions

- Evaluate possible solutions and decide which is most effective

- Plan and implement the solution

You can also be inspired by this simple four-step practical method, leading to effective and systematic problem solving:

- Identify the Details of the Problem: Gather enough information to accurately define the problem. This can include data on procedures being used, employee actions, relevant workplace rules, and so on. Write down the specific outcome that is needed, but don’t assume what the solution should be.

- Creatively Brainstorm Solutions: Alone or with a team, state every solution you can think of. You will often need to write them down. To get more solutions, brainstorm with the employees who have the greatest knowledge of the issue.

- Evaluate Solutions and Make a Decision: Compare and contrast alternative solutions based on the feasibility of each one, including the resources needed to implement it and the return on investment of each one. Finally, make a firm decision on one solution that clearly addresses the root cause of the problem.

- Take Action: Write up a detailed plan for implementing the solution, get the necessary approvals, and put it into action.

Source: https://cmoe.com/glossary/problem-solving-in-business/

Problem-solving and its methods can be used to evaluate business opportunities, another integral part of starting a new project or agricultural business. When considering business opportunities, you have to analyze their potential barriers and ways to overcome them.

To overcome these barriers do not forget to:

- Check national and local policies dedicated to Small and Medium Enterprises (SMEs), as well as rural development funding instruments of the Common Agricultural Policy (CAP)

- Contact national Advisory services for support programmes, etc.

- Look for cooperation opportunities & networking

- Check access to basic services, especially IT and broadband if you want to use them for your marketing.

The SMART way to check your entrepreneurial idea before taking action:

S – Specific: Is the objective clear? Is it clear what we exactly mean?

M – Measurable: How will we know if we have achieved it? How will we measure our success?

A – Attainable: Is it possible to achieve this goal? What do we need to make it attainable?

R – Relevant: Does it deliver wider priorities? Is it worth doing?

T – Time Based (in a time frame with a deadline): by when are we going to achieve this.

For coaching, there is a GROW model that can help you develop and reach your goals and become a good leader. Through certain questions, you can explore the different stages to better identify and reach your objectives.

The GROW coaching model can also help team members in improving their performance, and to help them plan to achieve defined goals and objectives of the organization.

Once your farming project is well defined, a business plan is drawn up, problem-solving methods are set up and business opportunities are

considered, it is time to evaluate the project.

- Assess market demand – Your idea could be brand new, but more than likely, there’s already something similar out there. Even the most ingenious business ideas rely on market demand.

- Identify your competitors – The key when evaluating your business idea is to find your competitors, look at what they are doing (or failing to do) and identify what you can do better.

- Potential customers – Try, for example, Facebook groups with similar topics, get information from surveys, polls, questionnaires on social networks,…

- Ask for feedback – Share your idea and plans with your friends, family, and colleagues to get instant feedback on your idea and look for external assessment expertise if available.

Agricultural business, like any other business, is run for profit. It is necessary to monitor economic indicators, legislation, subject to controls, etc.

On the other hand, there are certain specifics of which every person interested in doing business must be aware of in agriculture:

- Weather dependence: temperature differences, precipitation, drought, snow, etc.

- Differences in conditions: type of soil, climate, slope, altitude.

- Seasonality of work.

- A large number of regulations.

- Supplier of commodities at international standard.

- Dependence on sales prices in agriculture.

Before starting any form of financing, the necessary steps/questions should be clearly defined:

- What is the funding needed for? Capital costs, revenue costs, project or core costs…

- How much is required? How do you know? Have you included all costs?

- How urgent is your need? Do not make last-minute decisions, greater costs should be prepared ideally a year before – especially in agriculture.

- How much funding is already available? Possible sources – current and future ones, reserves…

- Link the funding needs to your business or corporate plan. Consider priorities, follow the organizational plan.

- Consult widely and engage others. It increases efficiency and decreases the possibility of failure.

- Be positive about your targets. Think of targets to be achieved, not shortfalls or deficits.

- Celebrate success. It is important to celebrate achievements.

We divide financial decisions into tactical and strategic.

- Tactical decisions usually require only small amounts of money and otherwise do not change the company‘s current activities (for example, buying agricultural machinery, acquiring larger stocks, improving a product, etc.). Tactical decision-making is often used to accomplish short-term goals.

- Strategic financial management is a term used to describe the process of managing the finances of a company to meet its strategic, or in other words, long-term goals. The wrong strategic decision brings great losses and can even liquidate the company.

- Managers and investors often follow these rules for financial decision making in the agriculture business:

- With the same risk, a higher return is always preferred to a lower return;

- For the same return, the lower risk is always preferred to the higher risk;

- A higher return is required for greater risk;

- It is preferable to receive the money earlier than the same amount of money received later (assuming that money that is obtained immediately can be further invested to bring in further return);

- The motivation for investing in a given action is the expectation of a higher return than the investment of another action would bring;

- The motivation for all investments is an increase in assets, but the criterion to be followed is to obtain a profit from the investments made.

The Common Agricultural Policy (CAP) was introduced in 1962 and is a partnership between agriculture and society, between Europe and its farmers.

Farmers must generate profits, but at the same time, they should work in a sustainable way. Due to business uncertainty and the impact of agriculture on the environment, the public sector is greatly involved with farmers. The CAP has the following tools at its disposal:

Income support through direct payments which ensures income stability, and remunerates farmers for environmentally friendly farming and delivering public goods not normally paid for by the markets, such as taking care of the countryside;

Income support through direct payments which ensures income stability, and remunerates farmers for environmentally friendly farming and delivering public goods not normally paid for by the markets, such as taking care of the countryside;- Market measures to deal with difficult market situations such as a sudden drop in demand due to a health scare, or a fall in prices as a result of a temporary oversupply on the market;

- Rural development measures with national and regional programmes to address the specific needs and challenges facing rural areas.

Find more information about the Common Agricultural Policy beyond 2020 here.

For the forthcoming period 2021-2027, a total of € 365 billion is proposed for the Common Agricultural Policy (CAP), which represents about one-third of the total EU budget. A combination of the different tools of both CAP pillars should be encouraged, such as the multi-annual agri-environmental measures of Pillar 2, e.g. for conversion to organic farming, and the annual eco-scheme (a new tool that can support sustainable practices, such as organic farming) of Pillar 1.

Current CAP strategies:

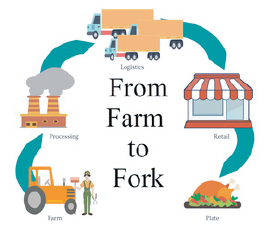

Current CAP strategies:

- EUROPAN GREEN DEAL – plan to make the EU‘s economy sustainable.

- FARM TO FORK – for a fair, healthy and environmentally-friendly food system.

Both strategies therefore include the target of reaching 25% of organically farmed agricultural land in the EU.

Many of these specific products for the agricultural market are traditional financing products in which the features have been adapted to the agricultural cycles. It is important to emphasize the importance of insurances as a mechanism to guarantee income and liquidity in the face of potential contingencies. It must be considered not only as a form of guarantee for the farmer but also for his or her families, customers, suppliers, and public entities.

- Once you have a business idea, write it down at first and then start organizing and developing it. A useful tool is the Business Model Canvas, but do not forget to make a „traditional“ business plan as well.

- Problem setting and solving is a key initial part of each business, whether it is in agriculture or another area. It is not good to act only intuitively here. It is a process that requires preparation, process setup, and evaluation. Do not underestimate it.

- Try to identify your financial needs. Decide how you want to finance the project. Prepare a contingency plan, include the alternative possibilities of funding if more sources are needed than you initially expected.

- Consider if you are able to start the business on your own. Do not be afraid to share your ideas and thoughts with people you trust, whether it is family, friends, or professional counselors.

- SYNEK, M. and KISLINGEROVÁ, E. Business Economics. 5., reworked, Prague: C.H. Beck, 2010

- KLONOWSKI, D. Strategic entrepreneurial finance: from value creation to realization. New York: Routledge, 2015

- Institute of Agricultural Economics and Information, How to start a business in agriculture, 2013 http://eagri.cz/public/web/file/261965/Jak_zacit_podnikat_v_zemedelstvi.pdf

- Center for Management & Organization Effectiveness, What Is Problem Solving in Business? https://cmoe.com/glossary/problem-solvingin-business/

- KONEČNÝ, L., How to plan a business, https://www.jic.cz/magazin/jak-na-business-plan/ (4 chapters)

- AL-GAYAAR, S., How to Evaluate Your Business Idea, 2018, https://www.jimdo.com/blog/how-to-evaluate-your-business-idea/

- American Society for Quality, What is problem solving? https://asq.org/quality-resources/problem-solving

- European Commission, The common agricultural policy at a glance, https://ec.europa.eu/info/food-farming-fisheries/key-policies/commonagricultural-policy/cap-glance_en

- Entrepreneur EUROPE, How to Write a Business Plan, https://www.entrepreneur.com/article/247575